How do I clear California EF Message 0069?

CA EF Message 0069 states:

CA Use Tax Error (New for 2017)

When use tax is equal to zero you are required by CA law to check one of the following boxes for the use tax on the main form.

CA540/CA5402EZ:

*No Use Tax Due

*Use tax obligation paid directly to CDTFA

Please go to CA > Taxes > USE screen and check the appropriate box.

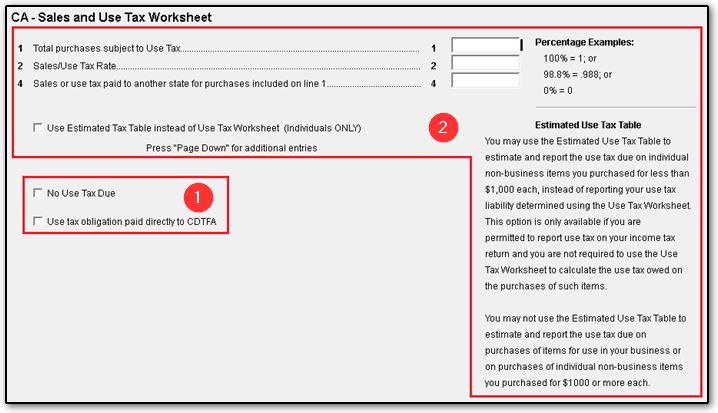

To clear this message, go to the States tab > CA > Taxes > screen USE (Sales and Use Tax Worksheet). This screen is used to compute the use tax owed or to indicate why no use tax is being reported on the return.

- If no Use Tax is due on the return, mark the box to indicate that "No Use Tax Due" or "Use tax obligation paid directly to CDTFA".

- If Use Tax needs to be computed on the return, complete lines 1-4 as needed to compute use tax due using the Use Tax Worksheet (appears in view/print mode as CAWK_USE).

- Certain individual taxpayers can compute use tax due using the Estimated Tax table instead of the Use Tax worksheet. To use the table instead of the worksheet, mark the box "Use Estimated Tax Table instead of Use Tax Worksheet (Individuals ONLY)" and complete lines 1-4 as needed. No worksheet appears in view when the Use Tax is calculated using this method.

Note: Use Tax is reported on CA 540 line 91 or on CA 5402EZ line 26.

Please refer to the CA 540 Instruction Booklet for more information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!