What entries do I need to make for the Kansas City Missouri, Profits Tax, Form RD-108 in an individual return?

Entries for the Kansas City Missouri, Profits Tax, Form RD-108 vary depending on whether the taxpayer is a resident or non-resident of Kansas City, Missouri.

Residents:

All business income for Kansas City residents is subject to the profits tax, regardless of where earned. The City of Kansas City, Missouri has requested a consolidated return be prepared for residents. This serves two purposes:

- To calculate a net profit or loss figure from all reportable income sources.

- To allow e-file of the return (otherwise, e-file is restricted to one RD-108 per individual).

When the Resident City on screen 1 is KC, the program will prepare a consolidated Form RD-108, Profits Return Earnings Tax from the data entered in the program. The amounts included in the calculation are as follows:

- All Schedule C data entered to arrive at profit or loss.

- When multiple Schedule Cs exist, this will be consolidated and printed on Form RD-108B, Schedule C.

- All Schedule F data entered to arrive at profit or loss.

- When multiple Schedule Fs exist this will be consolidated and printed on Form RD-108B, Schedule C.

- Schedule K1F net ordinary income or loss as entered in the federal column.

- This amount will flow to Form RD-108B, Schedule C, line 4 ‘Other business income’.

- Schedule K1P net ordinary income or loss and guaranteed payments as entered in the federal column.

- This amount will flow to Form RD-108B, Schedule C, line 4 ‘Other business income’.

Profits tax returns are required to be filed on an individual basis. When the Schedule C or Schedule F is J for joint income, this will be split 50/50 in the preparation of the RD-108.

Since investment income is not subject to the profits tax, the taxpayer and preparer have to make a determination of whether Schedule E and Schedule F income is investment income or business income. The Kansas City Revenue Department generally assumes that Schedule E income is investment income and Schedule F income is business income. The software calculation defaults to this assumption, however, this could vary on a case-by-case basis.

Note: Drake does not have the ability to generate the RD-108 from a Schedule E screen marked as joint. In order to allow the RD-108 to be created for each spouse, create two separate Schedule E’s for the same rental, one with the taxpayer’s portion and one with the spouse’s portion.

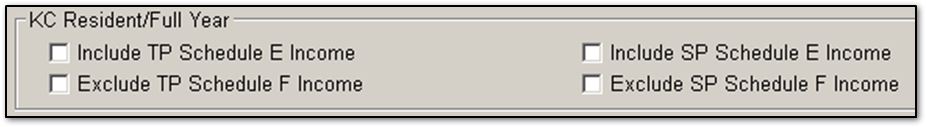

If you disagree with the treatment of the Schedule E or F income, you can make an adjustment by going to States > Missouri > Cities > 108 and using one of the check boxes to change the default calculation. Check either Include TP/SP Schedule E Income or Exclude TP/SP Schedule F income, as applicable. This election is available only to KC residents since a consolidated return is prepared for residents. If income was entered as belonging to both taxpayer and spouse (joint), be sure to select both the TP and SP checkboxes, as applicable:

Note: Kansas City treats S corporations as corporations for the profits tax. As such the S corporation is taxed at the entity level and the shareholders do not have a reporting responsibility for K1S income.

Non-residents or Part-Year Residents:

The tax applies to the net profits of all unincorporated businesses earned as a result of work done, or services performed or rendered, or business or other activities conducted in the city by nonresidents.

Part-year residents and nonresidents will have to identify which income sources are subject to the Kansas City RD-108, Profits Return Earnings Tax. When entering income information on the Schedule C, K1P, K1F, Schedule F, and Schedule E screens, select the state and city fields. If the income was earned in MO, select that in the state drop down and then designate the city as KC.

When KC is selected in the City drop list, program will prepare Form RD-108. A separate form will be prepared for each income source. This election applies to:

- Schedule C

- Schedule F

- Schedule E

Pass-through income from a partnership, K1P, or an estate or trust, K1F, will need to be directly entered on States > Missouri > Cities > 108 screen. Enter the Schedule Z distribution amount provided to the taxpayer by the pass-through entity on Form RD-108B, Schedule C, line 4 ‘Other business income’. By using the Ctrl + W function, a worksheet can be prepared listing the name and EIN of the pass-through entity, along with the distribution amount. Be sure to use this method to enter multiple K-1s on a single Form RD-108. This will generate a net number thus allowing losses to offset profits and minimize the tax liability.

Schedule Y, Business Allocation Formula, is used for nonresidents when preparing Form RD‑108 since the profits tax is based upon activities conducted in the city. Nonresidents should always complete the Schedule Y allocation, even if the net income is a loss. The default program calculation is 100% Kansas City source income and expenses.

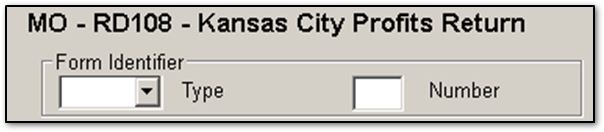

When entering information on screen 108, you must select the form to which the data entry is to flow to by using the Form Identifier and Number at the top of the screen.

Note: Kansas City treats S corporations as corporations for the profits tax. As such the S corporation is taxed at the entity level and the shareholders do not have a reporting responsibility for K1S income.

Note: Partnership income is taxed at the partner level unless an election is made to the contrary (see the Kansas City Earnings Tax Regulation publication for more information). As such, Partnership income will be carried to line 4 of the RD108T.pg2 or the RD108S.pg2 line 4 of the Individuals' RD108 unless the checkbox, found on the RD108 screen in Drake19, is used. This checkbox will tell the program that the K1 income was taxed at the partnership level and, when it is marked, the K1 income will no longer be included with the RD108.