Why does my PA-40, line 4 (Business Income or Loss from the Operation of a Business) not match the total of my federal Schedule C, E, and F? How can I reconcile PA40 line 4 to PA-40 Schedule C?

The amount that carries to the PA-40, line 4 flows from four possible places, starting in Drake18:

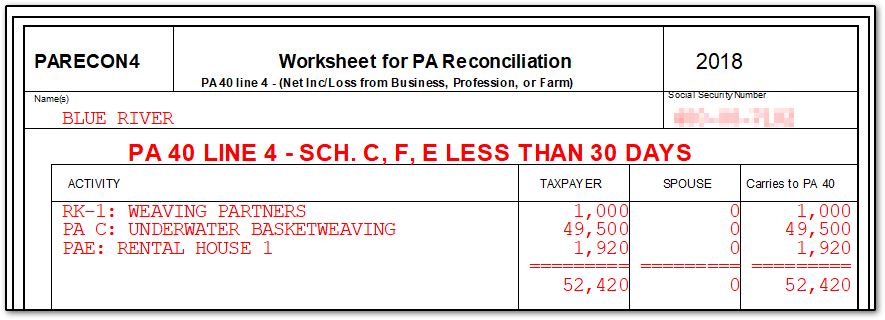

- 1065 K-1’s Ordinary Income that flows to PARK1 line 1 or PANRK1 line 1

- 1120S K-1’s Ordinary Income that flows to PARK1 line 1 or PANRK1 line 1

- PA-40 Schedule C

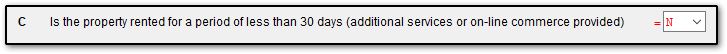

- PA-40 Schedule E when rentals have line C (Is the property rented for any period less than 30 days?) marked Yes.

- This is new for Drake18 per PA tax law changes (detailed below).

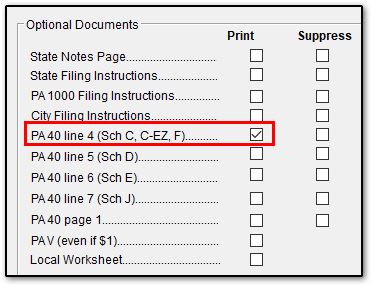

To see the reconciliation worksheet, go to the PA data entry, PRNT screen, and check the box under the Print column for PA 40 line 4 (Sch C, C-EZ, F).

In view mode, PA RECON WK 4 will be produced to reconcile the PA 40, line 4 amount:

By default, a rental is included in the line 4 amount when the Fair rental days on the federal E screen > Income/Expenses tab are less than 30. Per the PA 40 Instructions, pages 15-16:

"Report all income (loss) from business, farm, short-term rentals of

less than 30 days and business activity from partnership and PA S

corporation schedules....

Rental activity may be a business activity if meeting the conditions described below. If in business, report your net profit (loss) on a PA Schedule C. If not in the business of rents, report your rental activity on a PA Schedule E on Line 6. Report rental business when:

- You offer the use of your property with the intention of realizing a profit; and

- The leasing of your property is characterized by regularity and continuity of activities; and

-

You offer the use of your property on a commercial basis to others in a marketplace and at least one of the following applies:

- The average period of customer use is less than 30 days; or

- The property is customarily made available for use only during defined business hours; or

- In addition to the property, the taxpayer also provides significant services (see explanation below) to the lessee; or

- The taxpayer incurs significant operating expenses in making the property available for lease; or

- The leasing activity is incidental to a real estate sales business."

If you determine that a rental should not be included in line 4, you can use the override on the PA > E screen to change the answer to PA Schedule E, question C to No. Be sure to review the PA instructions and the field level help before using this override field.

This will remove the amount from PA 40, line 4 and the PA RECON WK 4 and show it instead on the PA 40, line 6 Rents and Royalties.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!