Drake Accounting®: How do I generate a Form 941-X to amend or correct the quarterly filing?

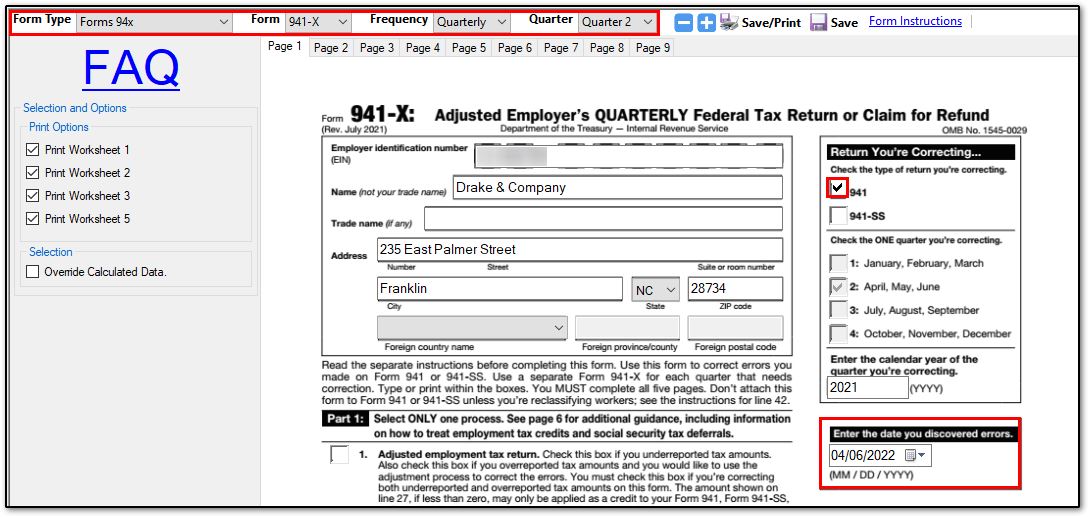

The 941-X form in Drake Accounting® can be used to amend any 941 or 941-SS quarterly report. Navigate to Employees > Federal Forms or On the Fly > Federal Forms and choose the following options from the drop lists:

- Form Type: Forms 94X

- Form: 941-X

- Frequency: Quarterly

- Quarter: Choose the applicable quarter that needs to be corrected.

In the Return You Are Correcting area at the top right of the 941-X form, you must indicate which form you are amending. The quarter is checked by the selection detailed above. Then complete any other necessary fields on the Additional tabs.

The 941-X must be paper filed as the modernized e-file (MeF) system does not support e-filing of the form. See the Form 941-X Instructions for details.

NOTE: There is a known issue with Worksheet 2, Line 2j not calculating as expected under certain circumstances when making corrections to the 2021 Q1 Form 941. For a workaround, enter an amount on Worksheet 2, Line 2b and then set it to its original value. This will update the applicable lines on that page.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!