How is the amount of income from other state(s) calculated on a RI 1040, line 24?

The Rhode Island 1040 Instructions indicate the following for line 24:

"Enter the amount of income derived from other state" and "Out-of-state gross income is determined in the same manner as that which

would be used for Federal purposes and generally includes the net amounts

of income that appear on the face of the other state's return or what would

be comparable to the face of the Federal Income Tax Return."

Thus, the amount that carries to line 24 of the RI 1040 is the taxable income, which may differ from the total income amount reported on source documents (Forms W2, 1099, etc.). Review the AGI amount calculated on the other state return to verify that the amount reported on RI 1040, line 24 is accurate. If adjustments are needed, RI screen R can be used to override the amount.

If there is a state that is not included on the return, screen R can also be used to directly enter additional state(s).

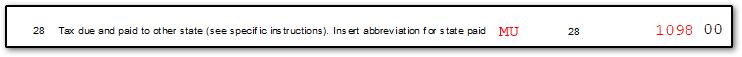

If there are multiple other states, review RI MU in view mode to verify the credit calculation. Note that RI 1040, page 3, line 28 will display MU as the abbreviation for the other state, if the worksheet is used for multiple states.

Rhode Island requires that the other state tax return be attached to the return. To complete the automatic attachment, once the other state return is complete, go to view mode and click the Attach PDF icon. Ensure that all states listed have a green check mark.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!