How do I check box 21 and/or 22 on Schedule K-1?

The K1 Instructions contain the following information about the purpose of these boxes:

- Box 21. More Than One Activity

for At-Risk Purposes

When the partnership has more than one

activity for at-risk purposes, it will check this

box and attach a statement. Use the

information in the attached statement to

correctly figure your at-risk limitation. For

more information see the discussion on

At-Risk Limitations earlier.

- Box 22. More than One Activity

for Passive Activity Purposes

When the partnership has more than one

activity for passive activity purposes, it will

check this box and attach a statement. Use

the information in the attached statement to

correctly figure your passive activity

limitation. For more information see the

discussion on Passive Activity Limitations

earlier.

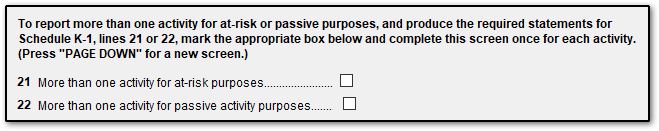

The IRS delayed the reporting requirement for indicating more than one activity for at-risk or passive activity purposes on Schedule K-1 in Notice 2019-66. The requirement effective date was delayed to taxable years beginning after January 1, 2020. Following that guideline, in Drake19, the boxes are present on the form in view mode, however, you cannot make an entry in either box.

In Drake20, checkboxes for boxes 21 and 22 are available on the BAS screen. The required statement attachment will be produced when multiple business activity screens (BAS) are completed (Press Page Down to open a new screen.) Information provided in the statement should be used by the partner to correctly figure at-risk limitations in the individual return.

For more information about at-risk and passive activity limits, see Related Links below.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!