On this 1120S/1065 return, the Pennsylvania Schedule E is not showing the K1P rental property correctly. How do I correct lines 22 and/or 23?

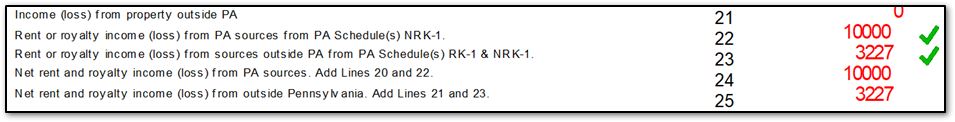

K1 Rental Income from Pennsylvania and other state sources are reported on the PA Schedule E, lines 22 and 23. Drake Tax makes the following assumptions when determining how to handle this income:

- The income was earned by a non-resident (NRK-1)

- The income is Pennsylvania source income

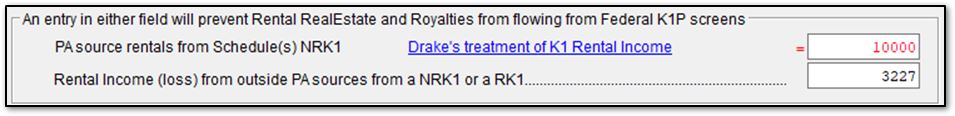

If this is not accurate to the facts of the return, adjustments can be made by going to PA data entry > screen E, Sch E Rents and Royalties. An entry in either field prevents Rental Real Estate and Royalties from flowing to PA from the federal K1P screen(s):

Entries made on these fields will carry to the PA Schedule E, lines 22 and 23, respectively.

For more information, review the PA Instructions.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!