How do I complete Form 7202 for a self-employed individual in Drake20?

In Drake20, Form 7202 is used to calculate Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. Per the 7202 Instructions:

"Eligible self-employed individuals are entitled to claim an income tax credit for qualified sick and family leave. To be an eligible self-employed person, you must be:

- Conducting a trade or business within the meaning of section 1402, and

- Eligible to receive paid sick leave under the Emergency Paid Sick Leave Act if you were an employee of an employer (other than yourself), and/or

- Eligible to receive paid family leave under the Emergency Family and Medical Leave Expansion Act if you were an employee of an employer (other than yourself).

You must maintain appropriate documentation to show that you are a qualified self-employed individual."

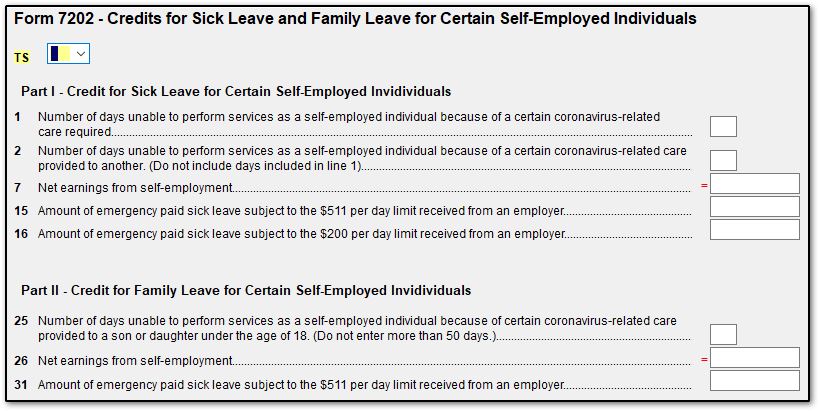

In an individual return, screen 7202 is available on the first Credits tab. Complete part 1 if the taxpayer is claiming a credit for sick leave. Complete part II if the taxpayer is claiming a credit for family leave.

Form 7202 is produced in view mode to calculate the eligible credit on either line 24 or 35 (part I or part II) to flow to Form 1040, Schedule 3, line 12b.

Note: The program calculates net self-employment earnings for the taxpayer (or spouse). An entry for line 7 or 26 overrides the program’s calculation. You can elect to use prior-year net earnings from self-employment to figure the credit if they are greater than current year net earnings. If the taxpayer elects to use the prior year amount, an entry must be made in box 7 or 26. See the IRS instructions for additional information. The IRS has said that line 7 and line 26 should report the same amount.

For more information, see the 7202 Instructions and Publication 5419.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!