Why is Note 357 about the Schedule E producing on this return?

The Notes page states:

SELF-RENTAL AND LAND GAINS HAVE BEEN RECHARACTERIZED: Under Reg. 1.469-2(f)(6), if a taxpayer rents property to a business in which he materially participates, net rental income is non-passive. Stated differently, rental income from self-rented property cannot be used to trigger allowance of passive income losses on Form 8582.

NOTE: If property was not rented to a business in which the taxpayer materially participates, it should not be marked as "self-rental" on screen E.

Under Reg. 1.469-2T(f)(3), net rental income from leased land is not passive income.

Since the self-rental or land property resulted in an overall gain for the current year, the gain has been recharacterized as non-passive and will not flow to Form 8582.

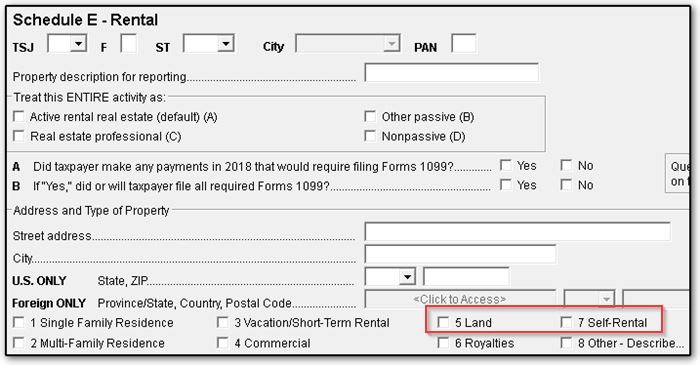

This note is produced when either 5 Land or 7 Self-Rental is selected on the E screen as the type of property:

Neither activity is considered passive according to the referenced IRC Regulation 1.469-2T(f)(3). Therefore, the software has reclassified these as non-passive and the gain will not flow to Form 8582.