Why is my Schedule C loss not showing on the return?

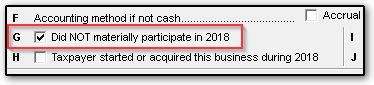

If the C screen in data entry (Income tab) is marked Did NOT materially participate in 20YY, the activity is treated as passive and is subject to passive loss limitations, calculated on Form 8582. This may prevent the loss from carrying to:

- Form 1040, Schedule 1, Part I, line 3 (Drake19 - 21)

- Form 1040, Schedule 1, line 12 (Drake18)

- Form 1040, line 12 (Drake17 and prior)

Note: In Drake15 and prior, a selection is made on screen C, line G from the Activity Type drop list.

If the loss is limited, it may not flow to line 12 of Schedule 1, but may be carried forward to future years. Other passive income may affect the outcome on Form 8582 and the 1040.

Check data entry on the C screen. If the business is not a passive activity, remove the check mark from line G.

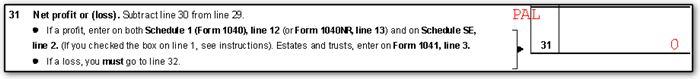

If the Schedule C is a passive activity and the loss is being carried forward, review Form 8582, the Wks CARRY, and the Wks PAL in view mode. When you view the Schedule C, line 31 will display the literal "PAL" to identify that this is a passive activity.