A fiduciary return shows a loss, but the K-1s are blank, and I cannot allocate the loss to the beneficiaries. Why?

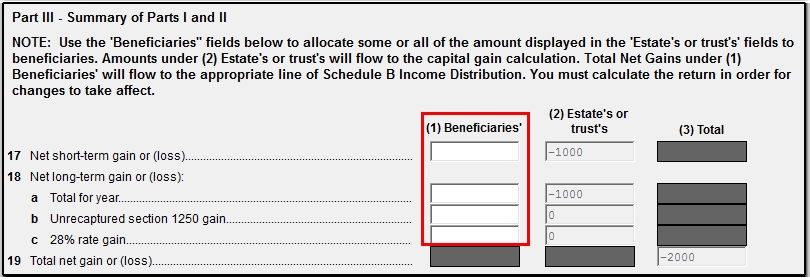

Losses do not flow to the K-1s until the final year of the return. While the D2 screen may be used to allocate amounts to beneficiaries, losses may not be allocated, and lines 17 and 18 do not allow negative numbers to be entered.

The losses will be carried over on the fiduciary return until they can be applied, or until the final year when they may be distributed. See Schedule D and Wks CG Loss.

If this is a final year 1041, for question F on screen 1, mark the Final return option and the losses will carry to the Schedules K-1 per IRS guidelines. On a final year K-1:

- Distribution of capital losses flow to line 11, Final Year Deduction, not to lines 3 and 4, Capital Gains.

- Distribution of net operating losses also flow Schedule K-1, line 11.

- Important: The loss amount still shows on Form 1041 to determine the amount to carry to the beneficiaries.

If there is a NOL being figured on Wks NOL, you may need to go to the NOL screen and check the box Election to carry forward ONLY. This will indicate that the NOL is not being carried back to earlier years first and only should be carried forward. Since this is a final year, the NOL will be carried to the beneficiaries instead. Important: The loss amount still shows on Form 1041 to determine the amount to carry to the beneficiaries.

For more information, see: