How do I enter a Qualified Charitable Distribution (QCD) in Drake Tax?

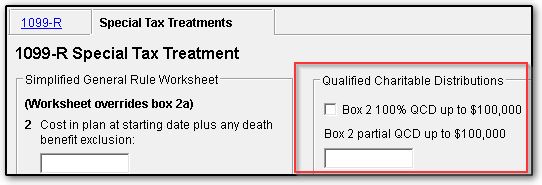

Open the 1099 screen. Enter a QCD by selecting the Special Tax Treatments tab at the top of the screen and choosing Box 2 100% QCD up to $100,000 or entering an amount under Box 2 partial QCD up to $100,000.

Notes:

- The limit per person is $100,000.

- If the 1099-R is entered as an IRA and Box 2 100% QCD up to $100,000 is marked, only amounts in excess of the $100,000 will flow to Form 1040

- A Qualified Charitable Distribution (QCD) is generally a nontaxable distribution made directly from an IRA by the trustee.

- Per Pub 590 instructions, you cannot claim a charitable contribution deduction for any QCD not included in your income.