When is the ST DEPR Schedule worksheet shown in view? Does Drake Tax calculate depreciation for multiple states?

The ST DEPR Schedule (ST_DEPR in Drake15 and prior) is only produced when one or more of the following conditions are true. The form cannot be forced to produce if there is no difference between federal and state depreciation being calculated on the return.

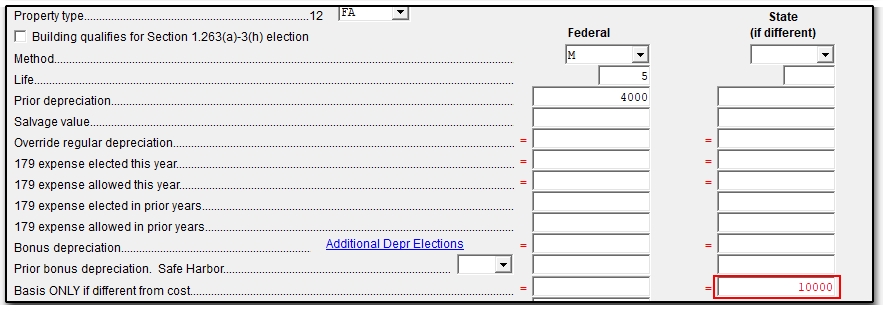

- The state basis differs from the federal basis. State basis can be entered on the 4562 detail screen under the State (if different) column.

- The method and/or life are different than what is chosen for the federal return. Return to data entry to verify entries on the 4562 screen(s).

- The state allowance for Section 179 expensing varies from federal limitations.

- The state does not allow for bonus (or special) depreciation.

Drake Tax calculates depreciation based on the resident state listed on screen 1 of federal data entry. If there are multiple states on the return, you must make any necessary adjustments on state input screens. Data entry and adjustments may vary depending on the state and federal schedules involved.