Interest dividends or interest are taxable to my state but exempt from the federal return. I entered an exempt interest dividend or exempt interest on the DIV or INT screen and it is not flowing to my state?

Tax-exempt interest income is reported on box 12 of Form 1099-DIV (box 11 in 2021 and prior, or box 10 in 2018 and prior). Enter the amount of exempt-interest dividends in the applicable box on the DIV screen.

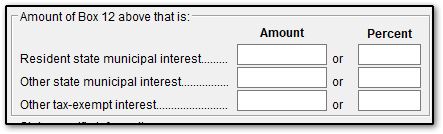

To indicate a breakdown of the interest from line 11 for state purposes, use the fields available at the bottom of the DIV screen.

Tax-exempt interest income is reported on box 8 of Form 1099-INT. Enter the amount of exempt interest in field 8 on the INT screen.

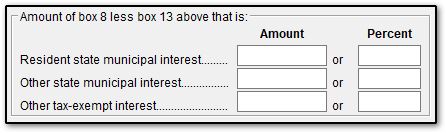

To indicate a breakdown of the interest from line 8 for state purposes, use the fields available at the bottom of the INT screen.

2012 And Prior Years

Amounts entered in line 10 of the federal DIV screen do not automatically flow to state returns.

There are two options to have the amount appear on the state return:

- Override the state return line.

- Use line 8 of the federal INT screen and select the affected state from the ST drop list at the top of the screen.