How do I indicate that a student is not claimed as a dependent on the parent’s return, but is considered part of the tax household for ACA purposes?

Due to changes from the TCJA, screen 8965 is not available starting in Drake19 as the penalty for not having minimum essential coverage is zero starting in tax year 2019. No exemptions are available, or necessary, starting with tax year 2019.

The following information applies to tax year 2018 and prior ONLY. This checkbox is not available in Drake19 and future and should never be used in relation to Form 8962.

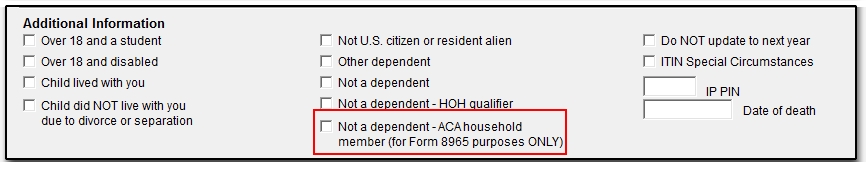

In Drake18 and prior, to include the person in the ACA Household for Form 8965 purposes only, on screen 2 (Dependents), mark the option Not a Dependent – ACA household member located in the bottom of the screen under the Additional Information section.

Review the Instructions for Form 8965 as to when this option can be used:

"Definitions

Tax household. For purposes of Form 8965, your tax household generally includes you, your spouse (if filing a joint return), and any individual you claim as a dependent on your tax return. It also generally includes each individual you can, but don't, claim as a dependent on your tax return.

...

Dependents of more than one taxpayer. Your tax household does not include someone you can, but do not, claim as a dependent if the dependent is properly claimed on another taxpayer's return or can be claimed by a taxpayer with higher priority under the tie-breaker rules described in Pub. 501."