Drake Accounting®: How do I set up a vendor?

Typically you would identify a vendor as anyone from whom the client makes regular purchases of goods or services, for whom an invoice is needed.

Setting up a Vendor

You can set up new vendors at Payables > Vendor Setup.

- Click New.

- Enter a unique Vendor Code (numbers, letters, or both) of up to 20 characters, preferably something that will help you recognize the vendor.

- Enter data in at least one of these fields: Company Name, First Name, Last Name.

- Choose the appropriate 1099 Options for this vendor:

- If the vendor does not require a 1099, select Do NOT generate a 1099.

- If the vendor requires a 1099, leave Do NOT generate a 1099 unchecked.

- Do not select this option if federal and/or state withholdings are going to be setup

- Complete other fields and tabs, as appropriate.

- All fields identified with

require entries before the vendor can be saved.

require entries before the vendor can be saved.

- Review your entries.

- When finished, click Save.

You can edit an existing vendor by double-clicking the vendor, entering or correcting information for the vendor, and clicking Save.

Vendor Withholding

Drake Accounting® now offers the ability to set up separate federal and state withholding under the Payables module for each vendor.

- Go to Payables > Vendor Setup > Withholding tab.

- When you check Calculate Federal or Calculate State, you are required to enter an amount.

- You can choose to apply a Dollar/Cents amount or a Percentage amount to be withheld from a vendor's payment.

For more information about Form 1099 filing requirements, see the IRS FAQ Am I Required to File a Form 1099 or Other Information Return?

Deleting a Vendor

To delete a vendor, go to Payables > Vendor Setup. Select the vendor, then select Terminated in the Status drop-list.

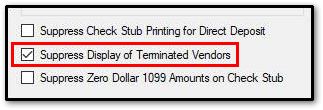

If you also do not want to see those vendors displayed, go to Payables > Options and check the option Suppress display of Terminated Vendors.