How do I enter goodwill on a group sale?

IRS defines goodwill as the value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor. For more information, see Publication 535.

First, enter the fair market value (FMV) of each asset that will be included in the group sale. This is entered in the override field "Fair market value of THIS asset" located on the 4562 screen.

Then create a 4562 or 4797 screen and enter the following:

- Description: Goodwill

- Date Acquired: Date the business started

- Cost/Basis: Leave blank

- Property Type: IA (Intangible Asset)

- Date Sold

- Group Sale Number

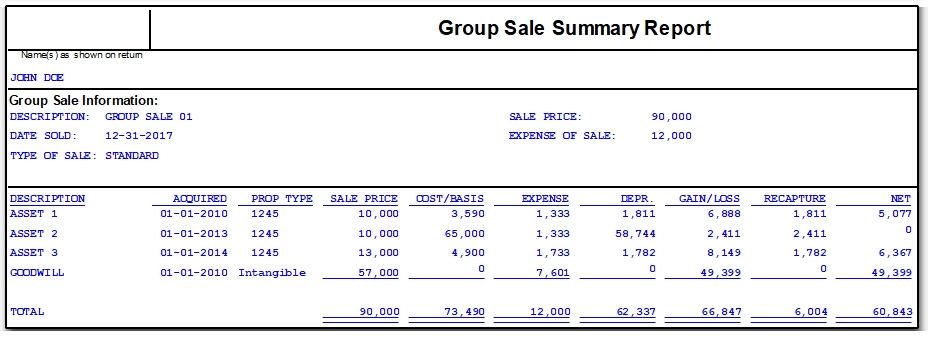

The software subtracts the total fair market value of all of the other assets in the group sale from the sales price. The remainder is carried to the zero cost asset on the "Group Sale Summary Worksheet."

Note: These steps will not work if you have more than one zero basis asset included in the group.

When a method and life are not selected on the 4562, the software will generate notes 474 and 475. The software will default to macrs as the method and 5 years for the life.