Is there a way to deliver the Forms K-1 to shareholders, partners, and beneficiaries through Drake Tax using email?

Yes, you can deliver Forms K-1 to the shareholders, partners, or beneficiaries of an S corp, partnership, or fiduciary easily and securely.

Important: You must have an active Drake Portals subscription before you can use this feature. If you are not currently a Drake Portals user, see Related Links below for more information, or sign up for a free trial.

Note: A client portal does not have to be created for the filing company, partner, or shareholder before proceeding with this process. If there is no existing client portal for the Email and SSN/EIN, you can choose to create one for the 1065/1120-S/1041 during the upload process and a portal is automatically created for any applicable partner/shareholders.

Follow these steps to upload the completed return to the officer/partnership representative and deliver the Forms K-1 to the partners, shareholders, or beneficiaries of a completed 1065/1120S/1041 return:

- Complete the 1120-S/1065/1041 return.

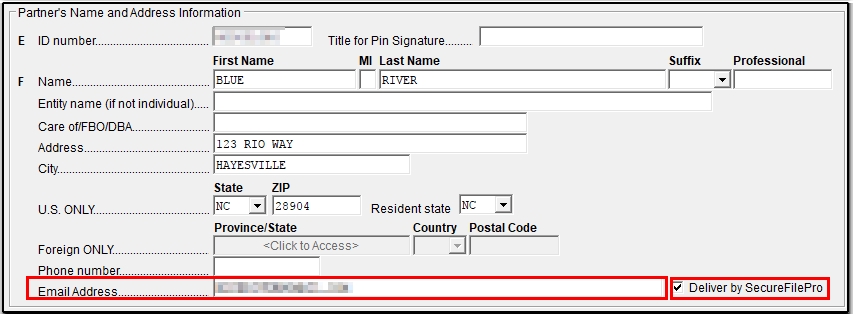

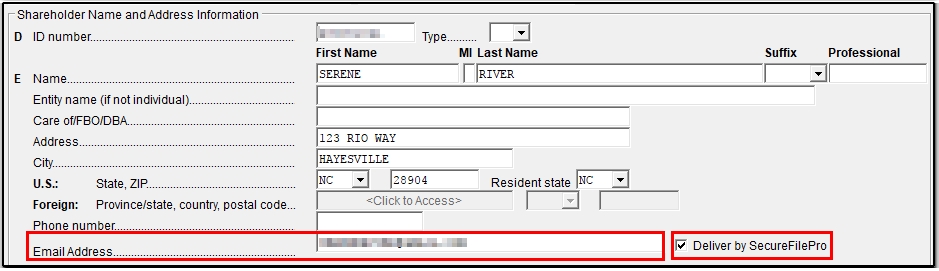

- On the federal K1/K1E screen for each partner/shareholder/beneficiary:

- Enter a valid email address in the Email Address, and

- Check the box Deliver by Drake Portals.

1065:

1120-S:

1041:

- View the return and select the forms to upload to the partnership, S corporation, or fiduciary.

- You can do this from either All Forms or Sets.

- Click the Print icon and select Upload to Client's portal (Upload to SecureFilePro in Drake19 and prior) on the printer dialog (this will also save a copy to Drake Documents).

- Optional: Password protect.

- You can also print to a real printer at this step if desired.

- Click Print.

- Save the PDF of the return.

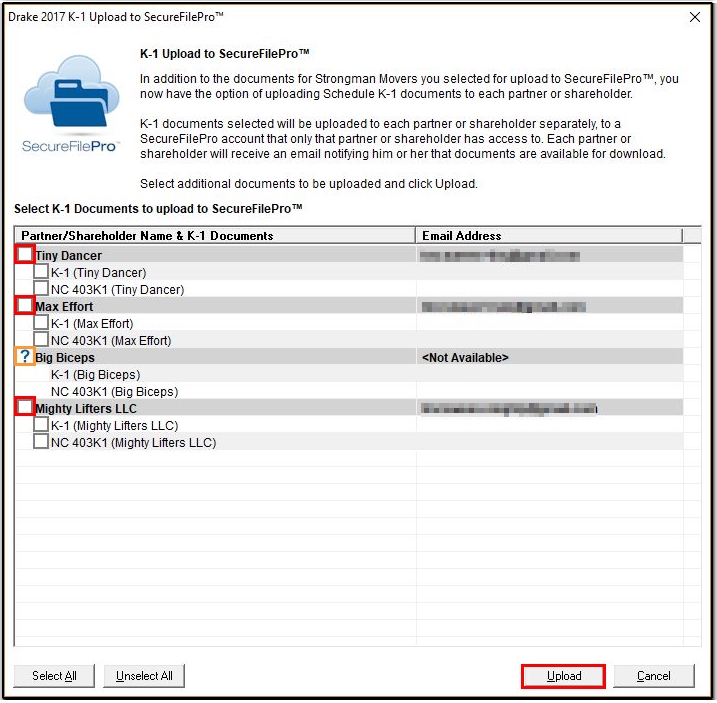

- A dialog box will open showing your additional K-1 Upload to SecureFileProTM options:

- Select the partner/shareholder/beneficiary and their K1(s) that should be uploaded. Note that state K1s will also show in this list for upload and can be selected.

- If a partner/shareholder/beneficiary email is missing or invalid and/or the Deliver by Drake Portals option is not selected on the federal K1 screen, a question mark will show instead of a clickable checkbox (see orange box above).

- After making your selections, click Upload.

- The software generates a separate PDF for each document and uploads the individual PDFs to the partner's/shareholder's/beneficiary's portal.

- If the partner/shareholder/beneficiary does not have a client portal already, a new portal is automatically created for each recipient and the document is uploaded to their Documents from Preparer folder.

- The File Upload Report displays and details what items were uploaded, and whether a new client portal was created for the shareholder/partner/beneficiary.

Each shareholder/partner/beneficiary will receive an email informing them that a new Drake Portals account has been created for them and that a document has been uploaded for their review. The contact person for the business will also receive an email notification that a document was uploaded.