What is Form FTB 3596 and why am I getting it when there is no EIC calculating for the state?

The FTB 3596 is the California's Paid Preparer's Due Diligence Checklist for California Earned Income Tax Credit. This form is required if there is a calculation - allowed or disallowed - for EIC on a return.

The FTB 3596 instructions state the purpose of the form as:

Paid preparers of California income tax returns or claims for refund involving the California earned income tax credit (EITC) must meet due diligence requirements in determining the taxpayer's eligibility for, and the amount of, the EITC. Failure to do so could result in a $500 penalty for each failure. See California R&TC Section 19167(a)(5) and Part III of [the instructions].

Only paid preparers have to complete this form. If you were paid to complete a tax return for any taxpayer claiming the EITC, attach the completed form FTB 3596, Paid Preparer's Due Diligence Checklist for California Earned Income Tax Credit to the original or amended Form 540 or Form 540 2EZ, California Resident Income Tax Return, or Long or Short Form 540NR, California Nonresident or Part-Year Resident Income Tax Return.

CA CPAs should leave the Registration Number field blank in Setup > Preparers to allow the checkbox CPA to be marked on Form 3596. The Power of Attorney Information section on Setup > Preparers should be completed instead.

( Read more from the CA Franchise Tax Board website, Instructions for Form FTB 3596)

If EIC is not allowed, how can I stop the form from producing?

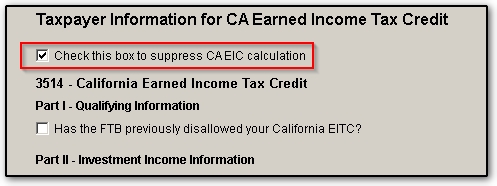

If you feel the form is unnecessary because of a known disqualifying factor, you can suppress the EIC calculation, thus removing the form requirement. To do this:

- Go to the CA screen EIC

- At the top of the window, select the box, "Check this box to suppress the CA EIC calculation"

- View the return

The form should no longer produce, because there is no calculation taking place.

What factors disqualify the CA EIC calculation?

Similar to the Federal EIC calculation, there are a number of factors that determine if the taxpayers return can qualify for EIC. The table below highlights the main factors and the conditions that cause disqualification.

| Filing Status |

Married Filing Separate |

Federal AGI

|

Greater than applicable threshold (based on number of eligible children)

|

| CA Investment income was |

Greater than $3,882 |

| Taxpayer or Spouse ID numbers |

No valid SSNs for employment |

| Federal Form 2555 or 2555-EZ |

Is Present |

| Taxpayer and spouse Residency |

Non-Resident Aliens at any time during the year |

| Primary Residence |

Not located in CA at least half of the year |

| Taxpayer or Spouse Age |

Under 25 or Over 65 |

| CA Earned Income |

$25,000 threshold For every $100 over the threshold amount, your credit is reduced by $20. |

(See CA Form FTB 3514 Instructions for additional direction regarding CA EIC)

Note: If the taxpayer did not have an SSN by the due date of their 20YY return (including extensions), they cannot claim the EITC on either their original or an amended 20YY return, even if they later get an SSN.

What common EF messages do preparers encounter?

California EF Message 0800 states:

CA EIC Dependent Address

One of the qualifying dependents has an address that is not "CA". Qualifying dependents must have an address in California. Please verify the address for all qualifying dependents is correct.

Drake Pro-Tip:

CA screen EIC2 is required when attempting to claim dependents for California EIC purposes.

To resolve this red message, complete one of the following steps:

- Review the mailing address that is present on Screen 1.

- If this address should be a California address, make the necessary changes so that it does reflect California, and recalculate the return.

- If this address should not be a California address continue to Step 2.

- Go to Data Entry > States Tab > California > General Tab > EIC2 Dependent information for EIC Screen.

- Select Qualifying Child SSN from the drop down menu at the top of the screen

- Press tab on your keyboard to auto fill the Child's First Name and Child's Last Name.

- Fill out the address section on the bottom of this screen with the California state address, where the dependent lived for the previous year.

Note: This process will need to be completed for each dependent on the return.

California EF Message 0044 states:

CA 3596 Paid Preparer Checklist

State Jurisdiction Line 1c. In order to e-file you must use the 2

digit state code. Entering the full state name will cause a parse

error when this form is e-filed.

Please return to Setup Preparer

and enter the 2 digit state code for the preparer's jurisdiction.

To clear this red message, take the following steps:

- Exit the client return and return to the Home screen of Drake Software.

- Go to the Setup menu> Preparers option.

- Double click on the name of the preparer receiving this error.

- From the Preparer Setup menu, locate the Power of Attorney Information section on the right side of the screen.

- In the field labeled Jurisdiction the 2 letter abbreviation for California (CA) should be entered.

- Click Save.

Once the 2 digit state code has been entered in the Preparer Setup, the message should be cleared