How can I resolve this IRS reject regarding a 990 return?

The IRS provides a lookup tool for 990 returns. You can review prior year filings to verify filer type, active tax-exempt status, exempt organization type, year end dates, and other data that may be causing an IRS reject in the current year. To use the IRS lookup tool:

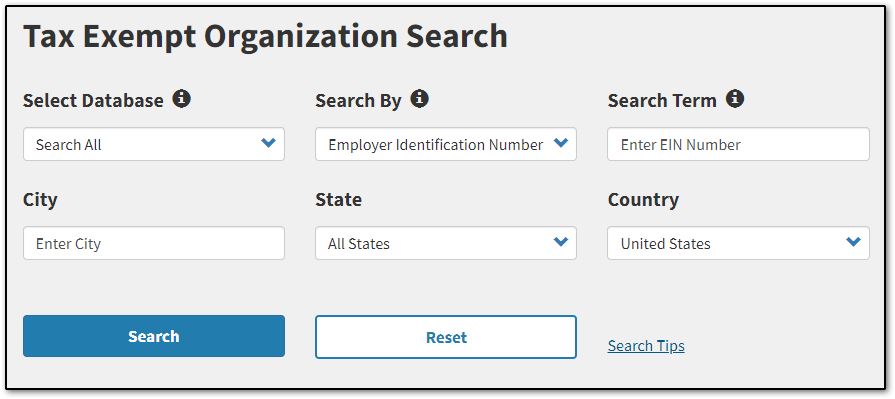

- Go to https://www.irs.gov/charities-non-profits/tax-exempt-organization-search.

- Select the Tax Exempt Organization Search Tool.

- Click the button Search for Tax Exempt Organizations.

- Enter the EIN of the organization and click Search.

Note: If the organization has not filed a return for 3 consecutive years, their exemption status is automatically revoked.

Another way to search is to review the master file data: https://www.irs.gov/charities-non-profits/exempt-organizations-business-master-file-extract-eo-bmf. This will allow you to compare the information on the rejecting return with the information available in the IRS database. Choose the appropriate state and download the .csv file. The file is sorted by the EIN of the tax exempt organization. Also open the information sheet for a breakdown of the file configuration and code details.

If you are unable to resolve the reject with the use of the IRS tool, you may need to contact the IRS directly for more information at (866) 255 - 0654.