I have a NJ fiscal year filer, but I see Note 31 instead of the NJ forms. How can I e-file the return?

Return Note 31 states:

Fiscal Year Dates have been entered that do NOT qualify for the current year forms. The new forms will not be RELEASED by the state until September or October. After that, the forms approval process must be followed. We will update the software as quickly as we possibly can after forms have been approved.

This situation requires the fiscal year NJ return to be filed on updated forms with the prior year federal return. To e-file the NJ return with the appropriate forms, do the following:

- In the prior year Drake Tax program, print the completed Federal return to a PDF and save it somewhere easy for you to access (for example on your desktop). It must be named FEDTAXRETURN.PDF.

- In the current year of Drake Tax, re-enter the information needed for the fiscal year NJ return.

- Most information can be entered directly, or overridden, on the NJ data entry screens, however, some information may need to be entered on the applicable federal screen(s).

- Disregard the federal messages (0084 and 0193) about invalid dates.

- Other EF message pages such as the ones about the PIN screen must be cleared to allow the NJ return to be e-filed.

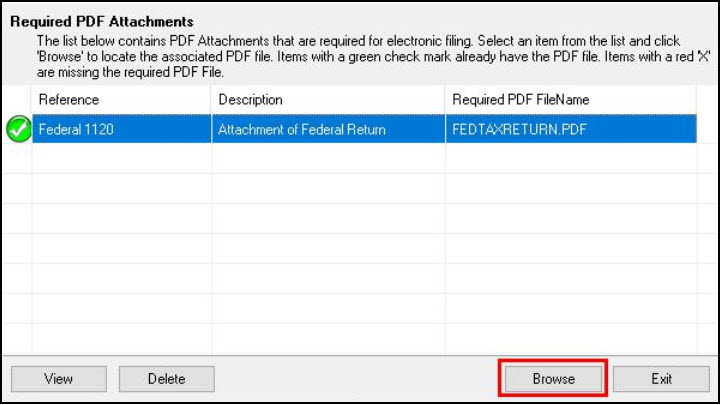

- Go to the NJ > PDF screen and complete the Reference, Description, and File Name fields. The File Name must be FEDTAXRETURN.PDF.

- Review the completed NJ return.

- In view mode, click the Attach PDF icon. The current year federal return may be automatically attached, however, the prior year return is required to be attached instead. Click on the Browse button and locate the PDF that was created in step 1. Select the PDF file of the federal return and click Open.

- On the EF screen, select to file the NJ return only.

- e-File the return as usual and verify that it is accepted.

Once accepted, make an archive copy of the filing by going to View mode > Documents > Archive client return. Name the archive something like "20YY NJ Fiscal Year." This will allow you to complete and file the federal 20YY return when needed. See Related Links below for details on archiving.

Note: If you are still seeing NJ EF Message 1165 after following the steps above, make sure that the name on the NJ > PDF screen has been entered as FEDTAXRETURN.PDF and that you have selected the PDF that was created in step 1. After updating the attachment, recalculate to clear the message page.