Drake Tax - Multi-Site Accounts

Article #: 17902

Last Updated: November 06, 2024

Note This article comprises former KB articles 17903, 18323, and 17902. It is herein referred to as KB 17902.

Important The following information applies only to setup options available for the parent account of a multi-site. Sub-offices may not have access to certain items shown below. Sub-accounts should contact the parent office for assistance.

Enable Access

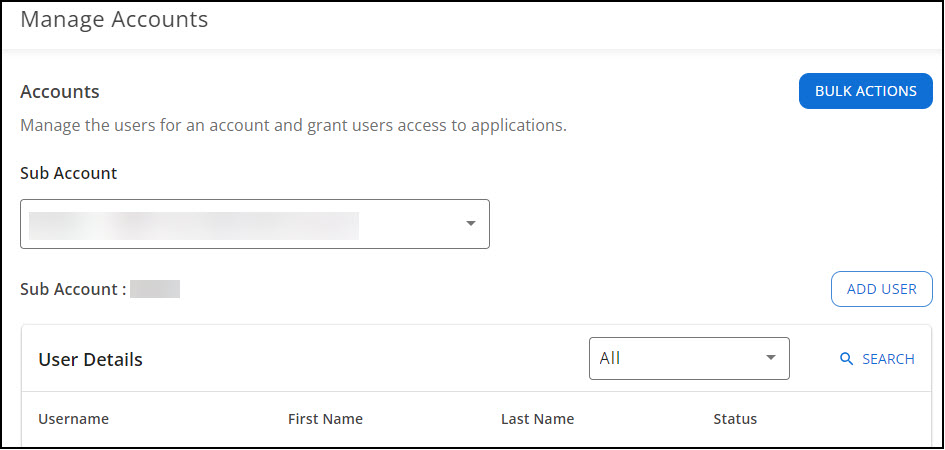

User access for the sub-accounts of a multi-site is configured using the Drake User Manager. See Drake User Manager – Overview and Configuration for details on basic setup. Multi-sites have additional options due to having a larger number of users and accounts. When the admin of a parent account logs in to the Drake User Manager, they have additional filters for sorting and adding users, including the abilities to sort by the sub-account or status and search for users.

Select a Sub Account from the list to individually add users to the respective sub-account. Bulk Actions are also available, allowing admins to apply a variety of actions to multiple users at once.

Bulk Import

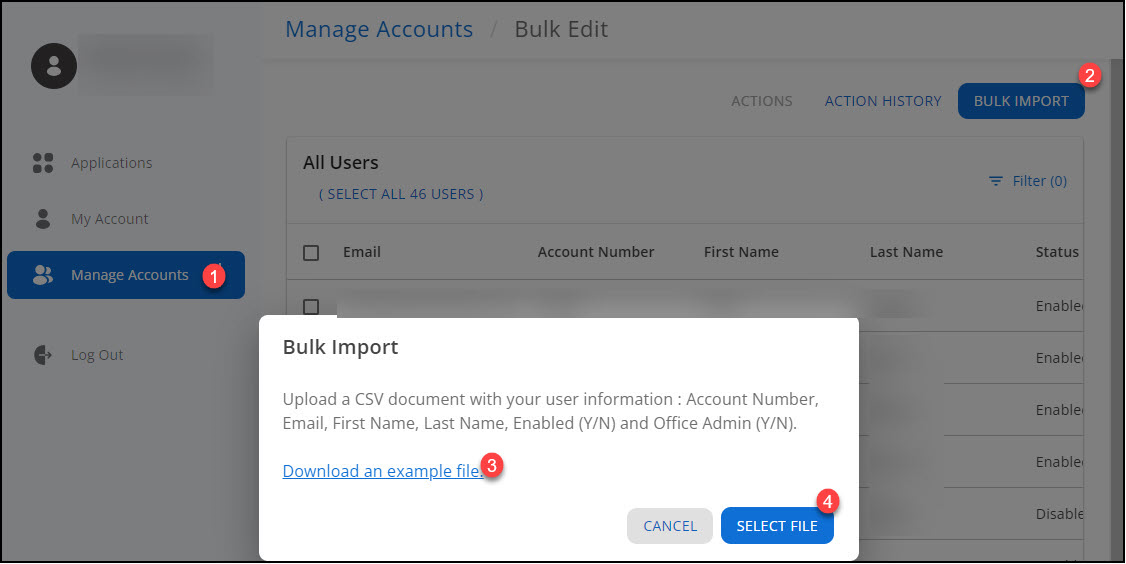

Admins can import a list of sub-account users using a pre-configured spreadsheet. To do so, log in to the Drake User Manager, and take the following steps (numbered correspondingly in the following image):

-

Click Manage Accounts on the left.

-

On the right, select Bulk Import.

-

Download an example file or verify that the file you created matches the required formatting. Column headers must be in the following order:

-

Account Number

-

First Name

-

Last Name

-

Email

-

Enabled (Y/N)*

-

Office Admin (Y/N)

-

-

Select the .csv file to import.

Note *Marking Y in the Enabled column creates the account, but does not send an activation email. Users added through the bulk process will need to use the Forgot Password process to complete their setup and log in.

Bulk Edits

Once your list of users is present on the Bulk Edit page, select two or more users from the list to perform a bulk action, including:

-

Add an application and role

-

Remove an application and role

-

Delete user

-

Enable user

-

Disable user

Drake User Account Settings

Account Information

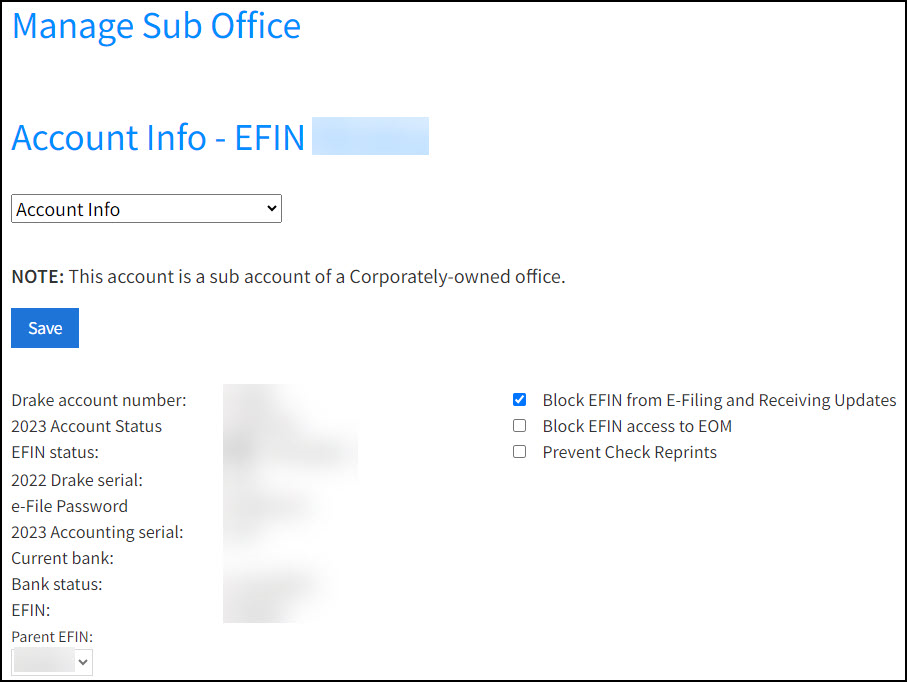

Multi-sites have additional setup options related to account settings that are not visible to single-site offices. The admin of the parent site can log in to their User Account and go to Account > Account info to select any of the following options for their sub-offices:

-

Block sub-office access to Download Center (User Account)

-

Lock network/franchise fees on sub-office bank applications

-

Lock add-on fees on sub-office bank applications

-

Hold shipments for all EFINs

-

Hold all mailings for all EFINs

-

Print franchisor/network firm name as the receiver of the "Additional Fee (Add-On)" on the tax return's bank information sheets

-

Allow parent accounts to create their own sub-accounts

Sub-Offices

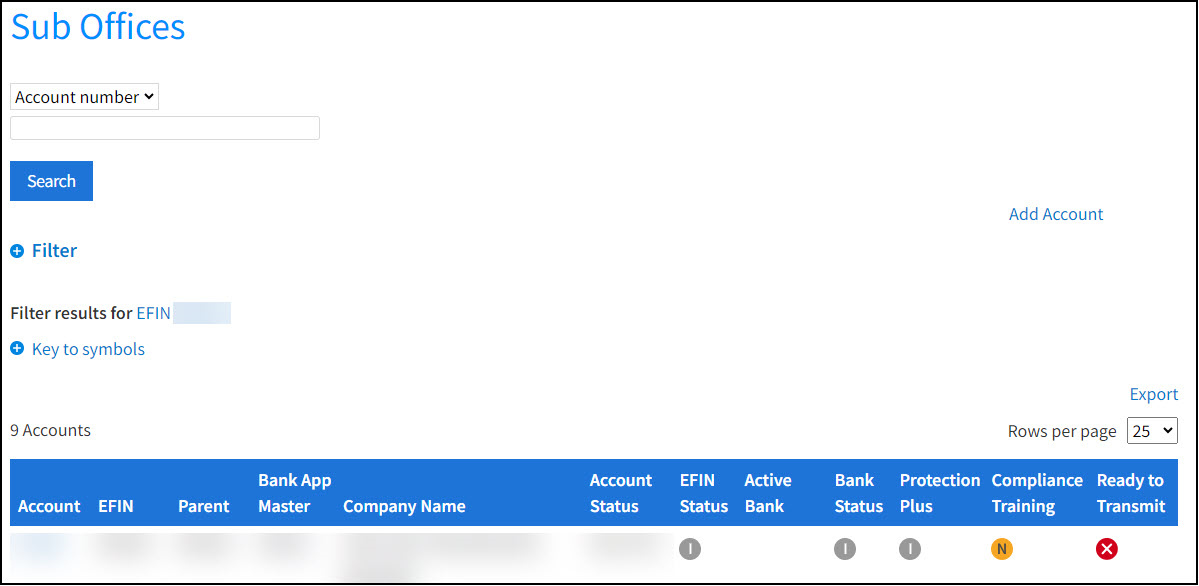

The admin of a parent site can log in to their User Account and go to Account > Sub-Offices to see a summary of information related to their sub-offices, including the status of each office. Filters are available for each column.

Click the applicable Account number on the chart to view additional setup items related to the selected sub-office.

The sub-offices chart can also be exported as a .csv file. The exported spreadsheet contains additional information that is not visible on the online summary chart.

Agreement

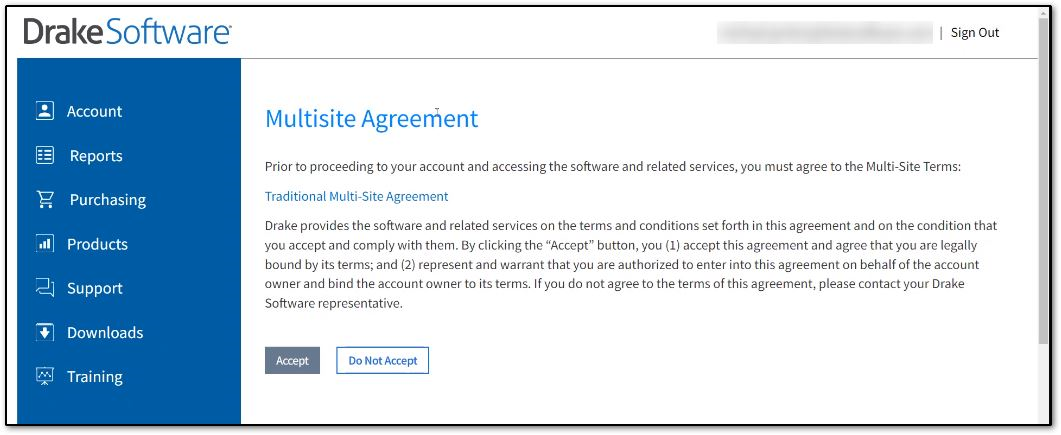

The following agreement displays the first time a user logs in to the master account, each year. No other account access is available until you have read and accepted the multi-site agreement. You must click the link Traditional Multi-Site Agreement which will open the document for review:

You will not be able to click Accept until you have opened the agreement and reviewed it.

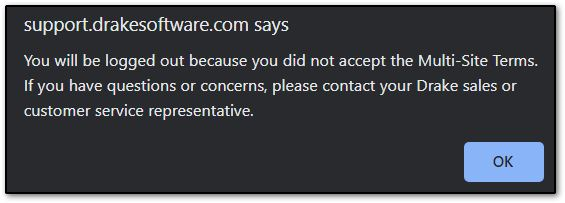

If you choose Do Not Accept, an alert will show, and you will be logged out of the support website.

Taxpayer Data Sharing

To enable or disable the sharing of taxpayer data with the master office under the preparer-to-preparer portion of IRC Section 7216, the sub-office can choose the option Allow taxpayer data sharing under Account > Account Info. The check box includes the following information:

As a licensee of the software through a master account, I represent to Drake that the master account is providing tax preparation and/or auxiliary services to me in connection with my tax preparation services. By choosing to share taxpayer data with the master account, I represent that this is a “preparer-to-preparer” disclosure authorized under IRC Section 7216. I understand that I may stop sharing with the master account by turning this feature off. Questions regarding this feature may be emailed to privacy@drakesoftware.com.

This selection allows the master EFIN to see the data on the Online EF Database or MOM reports.

The check box on the support website is not needed when the CONS screen is completed in data entry for every taxpayer prior to e-filing. See Drake Tax - Consent Forms for Use and Disclosure of Tax Return Information for more information about the consent to disclosure in Drake Tax.

Note This option is not available for a sub-account of a Corporately-owned office (franchise).