Drake Tax - 1040: EF Message 5709

Article #: 10878

Last Updated: December 05, 2024

Yes, however, you must enter the employee's identification number in the ITIN override field at the bottom of screen W2 exactly as it appears on the employer-issued Form W-2.

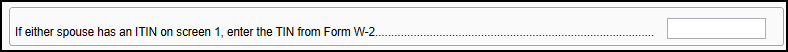

In an individual return, the program does not use a taxpayer’s or spouse's ITIN from screen 1 as the default for the box "Employee's social security number" on screen W2. It remains blank and the return generates EF Message 5709 to prevent e-filing. If the taxpayer's W2 displays a taxpayer identification number, you can remove the message and enable e-filing by entering the W2 TIN in the override field at the bottom of screen W2.

Once all message pages are eliminated, the federal tax return can be e-filed.

Note Many states, but not all, accept returns showing an ITIN on screen 1 and an SSN on a W2.