Drake Workflow (Beta)

Article #: 18870

Last Updated: February 18, 2026

Drake Workflow (Beta) is designed to help you monitor all your tax returns in a single system, organized by status and preparation stage. Drake Workflow (Beta) gives you complete control of your tax preparation firm’s productivity by helping you track tasks, assignees, and progress. This will help you ensure that your workflow is on track - from tax return creation, to preparation, and through to payment collection.

Drake Workflow (Beta) is integrated with Drake Hub. The beta version of Drake Workflow is available to try for free!

Tip For a video demonstration, watch Workflow Overview and Workflow Walkthrough.

-

Integrated Workflow: All apps work together with automation that update a client’s status as their return progresses. You can also update statuses manually to match your office workflow.

-

Task Delegation: Assign clients to team members in Drake Workflow (Beta). Each person completes their task and reassigns the client back to the preparer.

-

For example, a client submits documents through Drake Portals, the data entry clerk sees the status, enters the data, then updates the status so the preparer can filter for returns ready for review - all from within Drake Workflow (Beta)!

-

-

Practice Overview: Get a high-level view of all returns, broken down by category and status type. You can apply filters to pinpoint returns that require your immediate attention and ensure that all returns move through to complete by the due date that you set.

Overview

To access Drake Workflow (Beta), log into Drake Hub and select Workflow on the left.

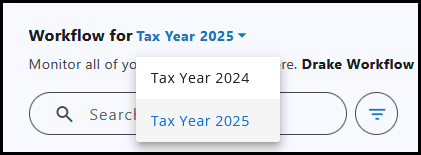

To view return statuses for a different tax year, click the year drop-down at the top of the window beside Workflow for and select the year you want to display from the list. Both Tax Year 2024 and Tax Year 2025 are now available.

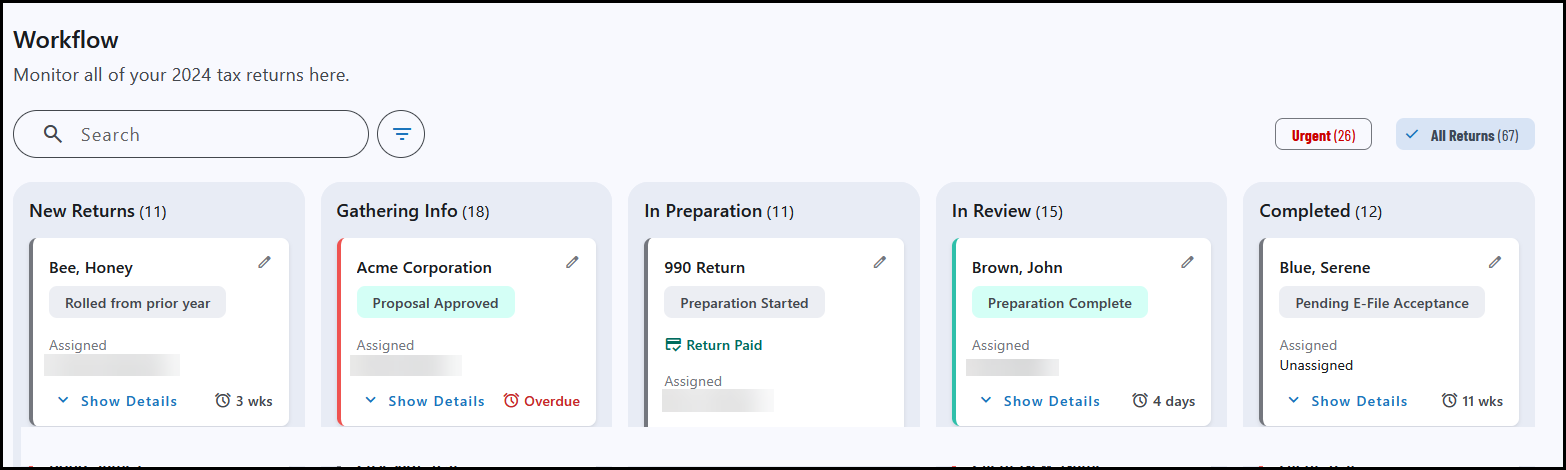

The board displays the five main stages of return preparation.

-

New Returns

-

Gathering Info

-

In Preparation

-

In Review

-

Completed

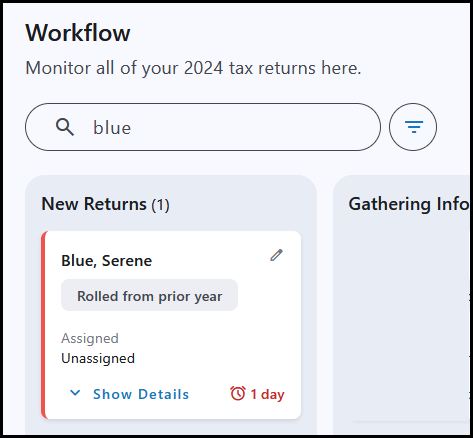

Each return has a more specific status displayed below the taxpayer’s name. When the status is updated through an automated or manual process, the return moves to the applicable stage (details below). Within each stage, returns are ordered in alphabetical order by the taxpayer’s last name or entity name.

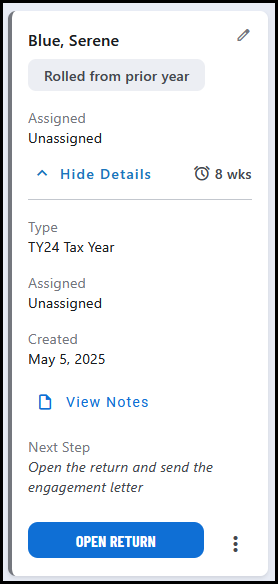

When reviewing a particular return on the board, click Show Details to get more information. The suggested next step is shown. In this example, the return was updated from the prior year, but data entry has not been started, so the suggested step is Open Return.

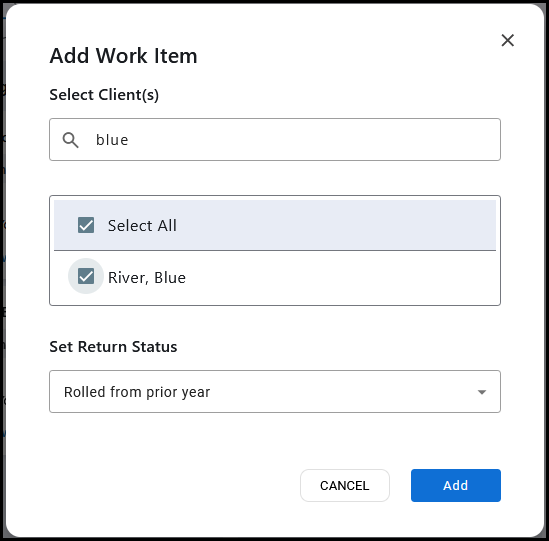

Add Work Items

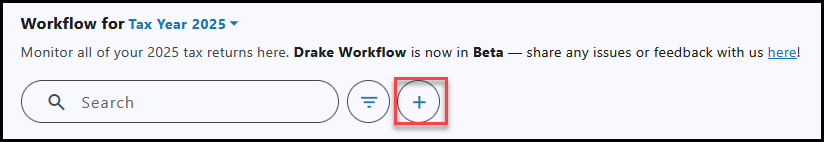

You can add work items for one or more clients to the Workflow by clicking the (+) icon beside the filter.

-

Search for a client, or select clients from the list.

Note Only clients that are not already present on the selected Workflow are displayed here.

-

Check the box to the left of the client name.

-

Set the return status for the selected client(s) using the Set Return Status drop list.

-

Click Add.

Stages and Status Types

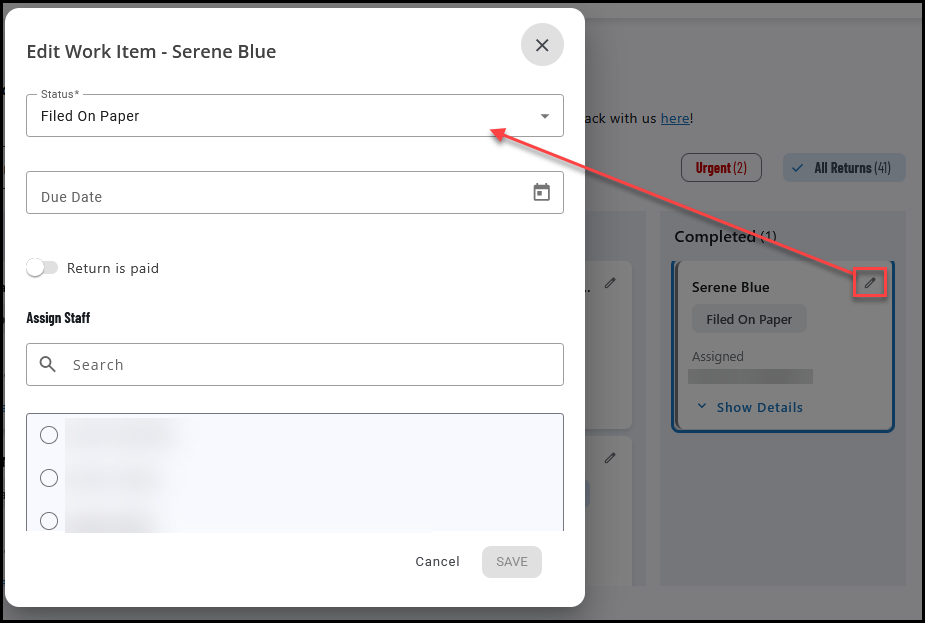

Most workflow statuses update automatically as a return progresses through the preparation stages in a connected application. You can also manually select or adjust the status as needed as it moves through your office’s workflow.

You can drag and drop the client tile to manually update the status, or click the Edit icon (pen symbol), choose the new status from the Status drop list, and click Save.

New Returns

-

Rolled from prior year - updated from the prior year of Drake Tax, but data entry has not begun.

-

Created new in Drake Tax - return created in the current year of Drake Tax, but data entry has not begun.

-

Prospect in Drake Hub - client information was added in Drake Hub (prospective), but a return has not been created in Drake Tax Desktop or Drake Tax Online.

Gathering Info

-

Pending Proposal - file uploaded to Drake Portals that is marked as Proposal. See Drake Portals - Request File Approval (Preparer View) for details.

-

Proposal Approved - taxpayer has completed their review of the proposed file in Drake Portals and marked Approve. See Drake Portals - File Approval Requests (Taxpayer View) for details.

-

Pending Engagement - engagement letter uploaded through Drake Portals (KBA not required).

-

Signed Engagement - taxpayer has signed the engagement letter using Drake Portals.

-

Pending Extension e-File Acceptance - an extension has been e-filed for this client’s return, but it has not yet been accepted.

-

Extension e-File Accepted - an extension has been e-filed for this client’s return, and it has been accepted.

-

Extension Filed on Paper - this status must be manually selected, if applicable.

-

Pending Data - the preparer requested taxpayer information using Drake Portals and at least one tasks has not yet been completed by the taxpayer.

-

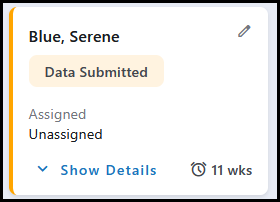

Data Submitted - the preparer requested taxpayer information using Drake Portals and all tasks have been completed by the taxpayer.

In Preparation

-

Preparation Started - this status must be manually selected, if applicable.

-

Amendment Started - this status must be manually selected, if applicable.

-

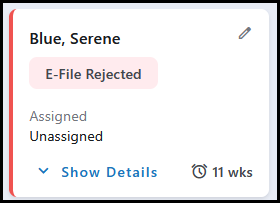

e-File Rejected - a return for this taxpayer was e-filed, but it has received an e-file rejection.

-

Extension e-File Rejected - an extension for this taxpayer was e-filed, but it has received an e-file rejection.

In Review

-

Preparation Complete - this status must be manually selected, if applicable.

-

Pending Approval - file uploaded to Drake Portals that is marked as Draft Return. See Drake Portals - Request File Approval (Preparer View) for details.

-

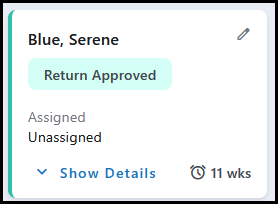

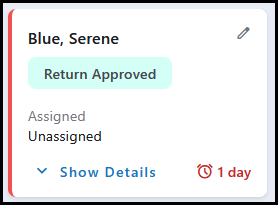

Return Approved - taxpayer has completed their review of the Draft Return file in Drake Portals and marked Approve. See Drake Portals - File Approval Requests (Taxpayer View) for details.

-

Pending Signature - preparer has requested an e-Signature using Drake Portals e-Sign Online (KBA required). See Drake Portals - Drake e-Sign Online for details.

-

Signed - taxpayer successfully e-signed their return. See Drake Portals - Drake e-Sign Online (Taxpayer View) for details.

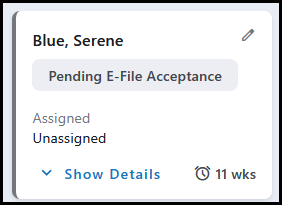

Completed

-

Pending e-File Acceptance - a regular return (not an extension) has been e-filed and is pending e-file acceptance.

-

e-File Accepted - a regular return (not an extension) has been e-filed and has been accepted.

-

Filed on Paper - this status must be manually selected, if applicable.

-

Return Cancelled - this status must be manually selected, if applicable.

Status Colors

Gray

Indicates that the return is in the normal process, and there are no urgent action items.

Yellow

Manual review is necessary to move the return through the process, but there are no urgent action items. Used for the Data Submitted status.

Red

Review of the return is urgently required. Used for e-File Rejected and Extension e-File Rejected.

Green

The return is ready to be completed. Used for Return Approved and Preparation Complete.

Outline Colors

Generally, the status color and client outline color will be the same, however, if the return due date is within 3 calendar days or overdue, the box outline will be red even if the status is gray, yellow, or green.

You must select the due date as it applies to each return. Due dates are not set by any automatic process and are primarily used for filtering.

Search or Filter

Enter a client’s name in the Search box to quickly find them on the board.

Click the Filter icon to narrow the client list by selecting one or more of the following:

-

Client Type

-

Status

-

Due Date

-

Owner

On the right, toggle between Urgent and All Returns to focus on items needing more immediate attention. The urgent list is populated if the return has a red status or a red outline (triggers for each color are discussed above).

Tip The Urgent option can be used with or without other filters to further limit results.

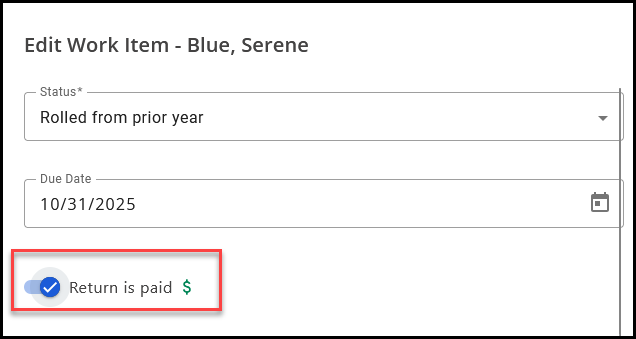

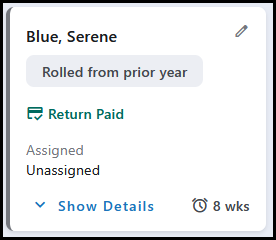

Return Paid

The Return Paid indicator indicates that the client has paid for their return. You can manually indicate this by clicking the edit icon in Drake Workflow (Beta), toggle Return is paid, and click Save.

Then, on the board, you will see Return Paid below the client status:

Frequently Asked Questions

Drake Hub is a centralized start screen that brings together all your Drake tools in one place. Accessible in Drake Hub, Drake Workflow (Beta) allows you to easily see the status of work as it moves through the preparation process.

Drake Workflow (Beta) automates repetitive steps in your process, such as tracking return progress, assigning tasks, collecting client data, and managing payments. With automation, you save time, reduce errors, and keep your entire team on track — without chasing paperwork.

Yes. Drake Workflow (Beta) integrates seamlessly with Drake Tax, Drake Accounting, Drake Tax Online, Drake Portals and e-Signatures. This allows your data, tasks, and progress to flow automatically between systems, giving you a complete picture of your firm’s workload.

Everyone in your tax practice can benefit — from preparers and administrative staff to managers and firm owners. By centralizing task tracking, Drake Workflow (Beta) helps each team member knows what needs to be done, who owns it, and when it’s complete.

Note Drake Workflow (Beta) is not available for multi-site offices at this time.

Yes. Drake Software is committed to modern, trusted security practices. Drake Workflow (Beta) is designed to protect client data while enabling automation across your firm.

The overall preparation stages and statuses cannot be customized.

Drake Workflow (Beta) provides a more comprehensive and intuitive way to manage your office operations by bringing the entire workflow and workload into a single interface. Statuses are updated automatically whenever changes occur, ensuring real-time accuracy. Additionally, Drake Workflow (Beta) integrates seamlessly with Drake Portals—updating return statuses when you use features such as proposals, engagement letters, or file uploads. A key function of the Client Status Manager (CSM), tracking e-file statuses, is now also available directly within Drake Workflow (Beta).

Drake Workflow (Beta) makes tracking your office’s workload simpler and more efficient. We invite you to explore the new interface with confidence, knowing that the CSM functionality is still available within Drake Tax Desktop and Rightworks.

| Feature / Capability Description | Drake Workflow (Beta) in Drake Hub | Client Status Manager in Drake Tax Desktop |

|---|---|---|

| Return workflow statuses automatically update when using Drake Portals and e-Sign | P | r |

| Return tracking for clients that exist only in Drake Hub or Drake Portals (track prospective clients). | P | r |

| Assign tasks to a staff member who may or may not be the signing preparer (e.g. seasonal help) | P | r |

| View client status from any device, including mobile devices. | P | r |

| Return workflow status automatically updates based on e-File Acknowledgements. | P | P |

| Return list is automatically populated* | P | P |

| Available for offices that use Hosting on Rightworks | P | P |

| Manually select or update status (override automatic function) | P | P |

| Workflow status tracking data is stored on (and only accessible from) local and/or network install** | r | P |

| Tracks return status for a return that is open or printed | r | P |

| Custom statuses*** | r | P |

*Drake Tax Online does not have an integrated Client Status Manager (CSM) - DTO users will use Drake Workflow (Beta) to track return statuses.

**Drake Workflow (Beta) is only available through Drake Hub - accessed through a web browser. There is no desktop version of Drake Workflow (Beta), so if you prefer to work locally, you will need to continue to use the CSM for return tracking.

***The statuses in Drake Workflow (Beta) were created in partnership with existing Drake Tax users to enable the end-to-end tax workflow status automation available in Drake Workflow (Beta).