Drake Portals - Drake e-Sign Online (Taxpayer View)

Article #: 16647

Last Updated: December 09, 2025

Once the preparer uploads a document for you (the taxpayer) to eSign ,you will receive an email notification that there are documents to review and sign.

Note Preparers should use Drake Portals - Drake e-Sign Online for more information on the in-office process.

If you have not set up an account login, the email will contain information and a link to set up your account as well as the instructions for signing the document.

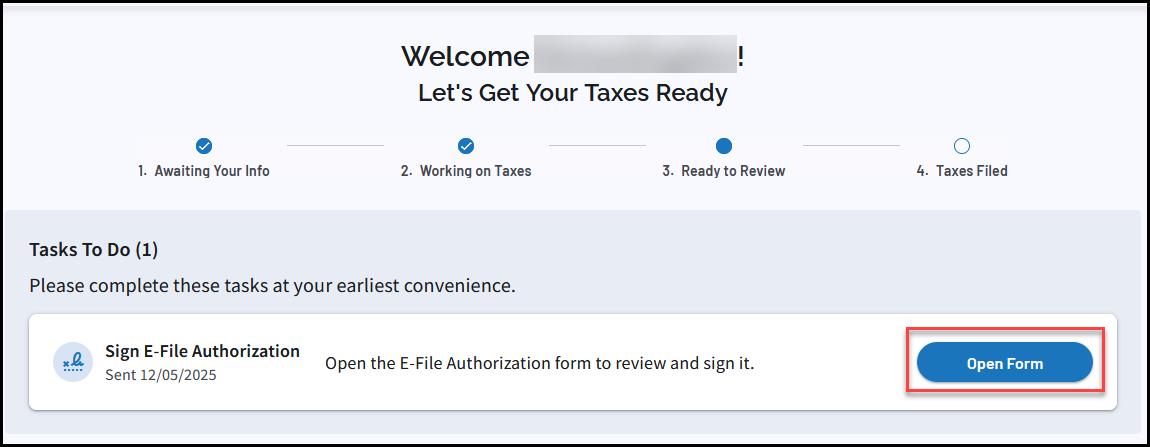

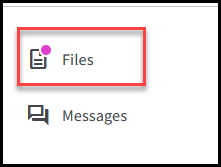

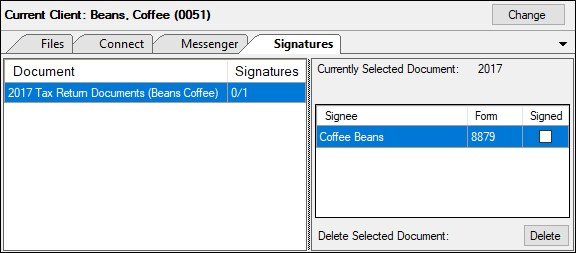

Once you create or log in to your Drake Portals account, you will see a new task for the signature document on the homepage, as well as an indicator next to the Files menu showing that there are forms waiting to be signed.

For more information, watch the videos Drake Portal Basics and How to Use Remote Signatures.

Note Taxpayers must be at least 18 years old in order to sign their federal tax return using Drake e-Sign Online.

Married Filing Joint returns - Different Addresses: The current version of Drake e-Sign Online only supports a single household address for both taxpayer and spouse. The verification software must be able to match both taxpayer and spouse to the address in order to ask the appropriate Knowledge-Based Authentication (KBA) questions of the taxpayer and spouse. We recommend not using an e-Sign Event when you are unsure if both taxpayers have ever lived at the address entered on the Name and Address screen in Drake Tax as e-Sign Events are non-refundable. A future release will include a “Spouse address if different” option.

System Requirements: Drake e-Sign Online is designed to work on iOS and Android devices, as well as Windows-based computers and Macs. We cannot guarantee that Drake e-Sign Online will work on all configurations, browsers, devices, platforms, and operating systems.

Signing the Documents

-

Select Open Form beside the Sign E-File Authorization task on the Home menu.

Note If the preparer uploaded a different type of signature document, the task label may vary (i.e., Sign Other Document, Sign Engagement Letter, etc.).

-

Alternatively, click the Filesmenu on the left (a dot signifies that there are new items).

-

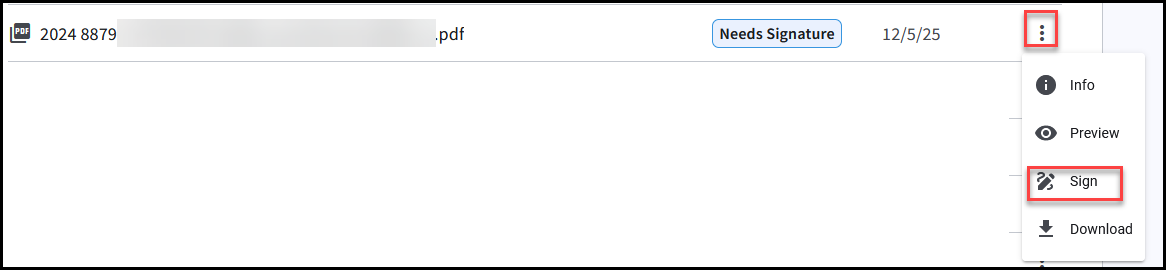

Click the three-dot menu beside the item that says Needs Signature and choose Sign.

-

-

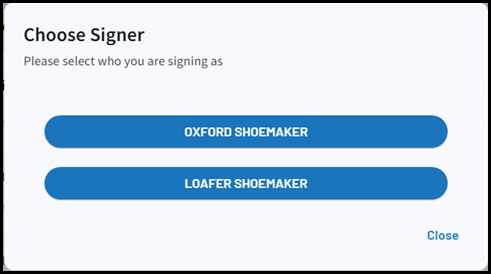

Select which taxpayer is signing (if prompted).

-

A notification window displays informing you of the Knowledge Based Authentication (KBA) Questions that must be answered to proceed. Click Continue to proceed.

-

This verification process is required the first time that you sign a document through Drake Portals.

-

You are presented with questions specific to your personal history, and you must correctly answer 3 out of 4 questions in order to proceed.

Caution If you do not answer 3 out of 4 KBA questions correctly, you will not be able to electronically sign documents for the remainder of the calendar year. This fulfills IRS requirements related to capturing remote signatures. See Publication 1345 for details.

When this is the case, signature documents are not displayed in the taxpayer's portal.

-

-

If you successfully answer 3 out of 4 questions, you will be able to apply your eSignature by using a mouse, stylus, or your finger in the Capture Signatures box, and click Next.

Note Available input options vary depending on the device being used to sign (e.g. computer vs. mobile device or tablet).

Important If there is a secondary taxpayer (spouse) on the return, they must also complete the steps above. If there is only one taxpayer, continue below.

-

Repeat the steps to apply signatures to all remaining fields, then click Submit Signatures.

-

After you have completed all signature fields and clicked Submit, your preparer will be notified so they can proceed with the return preparation. You can review your signature documents from the Files tab under Documents from Preparer at any time.