Drake Tax - KY - EF Message 1216

Article #: 16427

Last Updated: December 05, 2024

EF Message 1216 produces when the resident state on federal screen 1 is KY, and there is reported income on the return for an additional state(s).

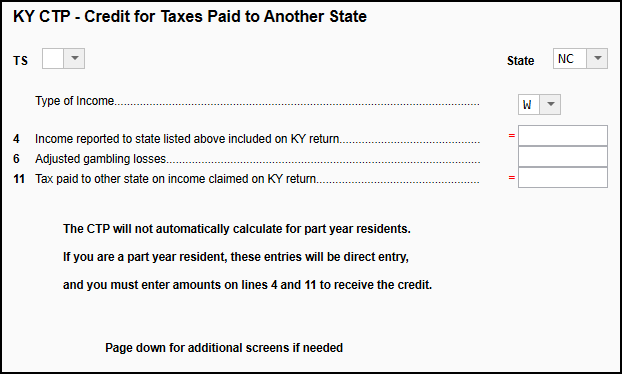

To clear this message and calculate the credit for taxes paid to the other state, go to Kentucky screen CTP, and select the state that the other income is for, and enter the type of income. For example: a W-2 from NC would be entered as state: NC, income: wages.

Note Part-year Kentucky residents will need to fill out all fields on KY screen CTP in order for the credit to produce. For part-year residents, the fields for income reported and tax paid are direct entry fields.

Information from screen CTP flows to KY CTP_WK to calculate the credit amount. The credit allowed then flows to KY ITC Credit Schedule and then to KY Form 740, line 15.

Kentucky does not allow a credit for taxes paid to a reciprocal state on the income listed below:

| State | Excluded Income Types |

|---|---|

| Illinois | Wages and Salaries |

| Ohio | Wages and Salaries |

| West Virginia | Wages and Salaries |

| Indiana | Wages, Salaries, and Commissions |

| Michigan | income from personal services, including salaries and wages |

| Wisconsin | income from personal services, including salaries and wages |

| Virginia | commuting daily, salaries, and wages |

Refer to Kentucky 740 instructions for details.