Drake Tax - Resolving DRKPARSE (Drake Parse) Errors

Article #: 10778

Last Updated: December 05, 2024

After e-filing a tax return, you may receive an acknowledgment with a DRKPARSE error.

Important This return will not be transmitted to the IRS or the state until the issue is corrected.

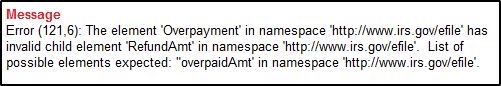

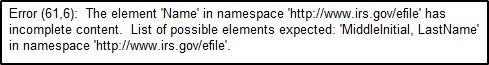

The parse error will look something like this:

The body of the reject detail has information that may help you identify the area to be reviewed. It may also help you determine if there is missing or incomplete information, incorrect data, etc.

Notes:

-

Check your data entry. Make sure data entered is complete and that it exists in the field in which it belongs (for example, the city in the city field and not in the zip code field).

-

Some errors are easier to diagnose than others. If you have difficulty determining where to look for the error, please contact Support at (828) 524-8020.

-

The numbers in parentheses will be used by Drake Support personnel to assist you.

Invalid child element

The phrase "invalid child element" refers to an incomplete data sequence within the return resulting in it being rejected. This phrase does not refer to a dependent listed on the return.

Rejects of this type are usually caused by:

-

Data entered in a primary data entry field with a required secondary field (the child element) left blank. In this case, the IRS is looking for required data in the secondary field.

-

Data entered in a secondary field (the child element) with the corresponding primary field left blank. In this case, the IRS is looking for information in the primary field.

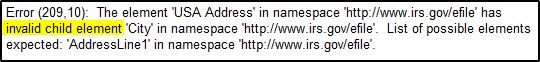

In this example from a state reject, the error picks up on the fact that data is either missing entirely or is not what was expected. (It appears that the first line of the address was missing.)

For example, the street address is missing from the taxpayer’s address, or an alpha character is appearing in a field that is designated as a numerical field only.

-

Many DRKPARSE errors are related to part-year state returns. Make sure dates moved in/out of a state do not overlap, state codes have been entered where required, and addresses are complete.

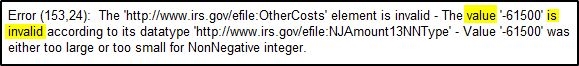

Value is invalid

This type of parse error reflects the issue that the value found was not what was expected -- in this case a negative value has been entered where a positive value was expected.

-

Search through the return for any instance of the value that is in quotation marks. This type of error message may generate when punctuation is used where it is not allowed, extensions such as MD are used after a name, or a negative number was entered where one is not allowed. If the error refers to the zip code, remove the hyphen and enter only the 5 or 9 digits.

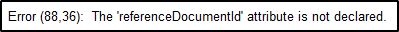

ReferenceDocumentId

This message generates when the return includes a blank form, schedule, or statement.

-

Verify that all Ctrl + W detail worksheets in the return have descriptions for all amounts and no blank lines are included.

-

Verify that all schedules and forms have been completed as necessary.

-

If there is a required PDF attachment to the return, the file name must be exactly as given in the EF_PDF page of the return.

Incomplete content

This acknowledgment usually means there is missing, or incomplete, information on the return.

-

Common causes are punctuation in a name (John A. Smith or Mary Doe, CPA), or a Married Filing Separate (MFS) return does not include the spouse’s name and SSN.