Drake Tax - Qualifying Child or Relative

Article #: 12071

Last Updated: December 05, 2024

Note This article comprises former KB articles 12071 and 11529. It is herein referred to as KB 12071.

A “qualifying child” is defined in Publication 501 as part of the eligibility for claiming a dependent:

There are five tests that must be met for a child to be your qualifying child. The five tests are:

-

Relationship

-

Age

-

Residency

-

Support

-

Joint return

This definition is used with modifications as part of a taxpayer’s eligibility for the five tax benefits listed below. For each benefit, the taxpayer also must meet other conditions besides those that define a qualifying child. See the related IRS publication for details.

-

Head of household filing status (see Publication 501)

-

Child and Dependent Care Credit (see Publication 503)

-

Child Tax Credit (CTC) (see Publication 972)

-

Earned Income Credit (EIC) (see Publication 596)

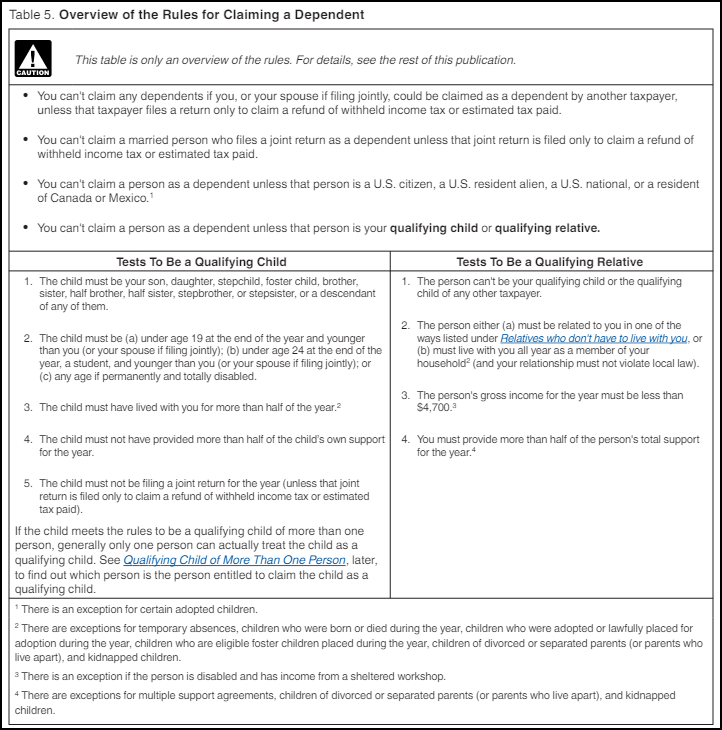

Table

The table from Publication 501 will help you determine if a qualifying child or relative can be claimed as a dependent. This is only a guideline. Review the instructions for Form 1040, and Publications 17, 501, 596 and other information as applicable. For tax benefits other than a claim of dependency, the criteria for a qualifying child or relative may vary from those listed in the table.

Qualifying Child for EIC Purposes

For purposes of earned income credit, "qualifying child" is defined in Publication 596 in terms of the four tests quoted below. See the publication for details and examples.

Relationship Test

"To be your qualifying child, a child must be your:

Son, daughter, stepchild, foster child, or a descendant of any of them (for example, your grandchild), or

Brother, sister, half brother, half sister, stepbrother, stepsister, or a descendant of any of them (for example, your niece or nephew)."

Note An adopted child is treated as the taxpayer's own child. For purposes of EIC, a foster child is a child placed with the taxpayer by an authorized placement agency or by judgment, decree, or other order of the court of competent jurisdiction.

Age Test

"Your child must be:

1. Under age 19 at the end of [the tax year] and younger than you (or your spouse, if filing jointly),

2. Under age 24 at the end of [the tax year], a student, and younger than you (or your spouse, if filing jointly), or

3. Permanently and totally disabled at any time during [the tax year], regardless of age."

Note Publication 596 defines "student" and "permanently and totally disabled".

Residency Test

"Your child must have lived with you in the United States for more than half of [the tax year]. The following paragraphs clarify the residency test.

United States. This means the 50 states and the District of Columbia. It doesn't include Puerto Rico or U.S. possessions such as Guam.

Homeless shelter. Your home can be any location where you regularly live. You don't need a traditional home. For example, if your child lived with you for more than half the year in one or more homeless shelters, your child meets the residency test.

Military personnel stationed outside the United States. U.S. military personnel stationed outside the United States on extended active duty are considered to live in the United States during that duty period for purposes of the EIC.

Extended active duty. Extended active duty means you are called or ordered to duty for an indefinite period or for a period of more than 90 days. Once you begin serving your extended active duty, you are still considered to have been on extended active duty even if you don't serve more than 90 days.

Birth or death of child. A child who was born or died in [the tax year] is treated as having lived with you for more than half of [the tax year] if your home was the child’s home for more than half the time he or she was alive in [the tax year].

Temporary absences. Count time that you or your child is away from home on a temporary absence due to a special circumstance as time the child lived with you. Examples of a special circumstance include illness, school attendance, business, vacation, military service, and detention in a juvenile facility.

Kidnapped child. A kidnapped child is treated as living with you for more than half of the year if the child lived with you for more than half the part of the year before the date of the kidnapping or following the date of the child's return. The child must be presumed by law enforcement authorities to have been kidnapped by someone who isn't a member of your family or the child’s family. This treatment applies for all years until the child is returned. However, the last year this treatment can apply is the earlier of:

The year there is a determination that the child is dead, or

The year the child would have reached age 18.

If your qualifying child has been kidnapped and meets these requirements, enter “KC,” instead of a number, on line 6 of Schedule EIC."

Note In Drake Tax, select KC from the Months in Home drop list on screen 2 Dependents to indicate that the qualifying child was kidnapped.

Joint Return Test

"To meet this test, the child cannot file a joint return for the year....

Married child. Even if your child doesn't file a joint return, if your child was married at the end of the year, he or she can't be your qualifying child unless:

-

You can claim the child as a dependent, or

-

The reason you can't claim the child as a dependent is that you let the child's other parent claim the child as a dependent under the Special rule for divorced or separated parents (or parents who live apart) described [later in Pub 596]."

Qualifying Child of More Than One Person

Sometimes, a child meets the relationship, age, residency, support, and joint return tests to be a qualifying child of more than one person. Although the child is a qualifying child of each of these persons, only one person can actually treat the child as a qualifying child to take all of the following tax benefits (provided the person is eligible for each benefit).

-

The child tax credit or credit for other dependents.

-

Head of household filing status.

-

The credit for child and dependent care expenses.

-

The exclusion from income for dependent care benefits.

-

The earned income credit.

Relatives who do not have to live with you

A person related to you in any of the following ways doesn't have to live with you all year as a member of your household to meet this test.

-

Your child, stepchild, foster child, or a descendant of any of them (for example, your grandchild). (A legally adopted child is considered your child.)

-

Your brother, sister, half brother, half sister, stepbrother, or stepsister.

-

Your father, mother, grandparent, or other direct ancestor, but not foster parent.

-

Your stepfather or stepmother.

-

A son or daughter of your brother or sister.

-

A son or daughter of your half brother or half sister.

-

A brother or sister of your father or mother.

-

Your son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

Any of these relationships that were established by marriage aren't ended by death or divorce.

Dependent Over Age 24

Based on the information in the table above, a child over the age of 24 may qualify as a dependent relative. The software allows the tax preparer to make this determination.

Girlfriend or Boyfriend

See the instructions for a qualifying relative in the table above.