Drake Tax - 1065: Name Control Reject R0000-922

Article #: 12293

Last Updated: December 05, 2024

There are four situations that would cause this reject. Each is listed below with its correction.

-

The partnership changed its name after the EIN request on Form SS-4 was filed with the IRS. Correction: For a name change, the name change box must be marked on screen 1 to inform the IRS. The IRS data records will be corrected accordingly.

-

The partnership was originally a sole proprietorship that was changed to a partnership after the EIN was issued. Correction: For a change in entity type, complete Form 8832 and transmit it with the return.

-

On screen 1, enter the partnership name in the Name field. If there is a DBA name, enter that in the DBA or c/o field.

-

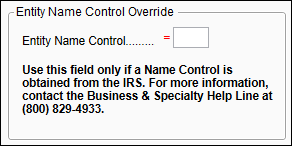

The name control on file with the IRS does not match the name control automatically generated by the software. Correction: Contact the IRS (Business and Specialty Tax Line, 800-829-4933), verify the partnership’s correct name control and enter only that name control in the override field. The Entity Name Control override is located on screen 1:

For more detailed information about partnership name controls, see the IRS article Using the Correct Name Control in e-filing Partnership Tax Returns.