Drake Tax - 1040: EF Message 0131

Article #: 13146

Last Updated: December 05, 2024

To resolve this EF Message, check screen 2, Dependents.

-

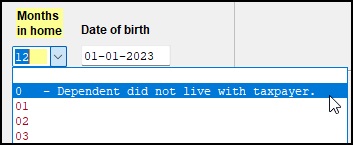

On screen 2, select 0 - Dependent did not live with taxpayer from the Months in Home drop list. If you leave it blank, the software defaults to 12 months.

-

Make sure there are no blank Dependents screens in data entry. If one exists, delete it.

Under Additional Information at the bottom of the Dependents screen, if Child did NOT live with you due to divorce or separation is selected and Months in home is blank or anything other than zero, EF Message 0130 is produced. If Months in home is blank, the software defaults to this condition.