Drake Tax - NY: EF Message 0199 - Local Withholding on 1099-G

Article #: 14010

Last Updated: December 05, 2024

Guidance received from New York specifically addresses how to record local withholding that is reported on Form 1099-G (Other Government Payments). The state of New York requires any local withholding reported on a Form 1099-G to be combined with the state withholding and then reported as a combined total in the State withholding field on the federal 99G screen.

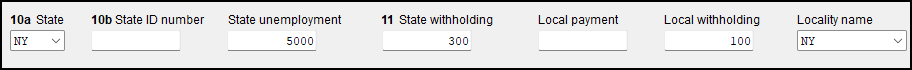

Below is an example of a scenario that will prompt EF Message 0199:

To correct EF Message 0199:

-

locate the 99G containing the entry for New York Local Withholding.

-

Take note of the amount reported in the Local withholding field and remove it.

-

Increase the amount in the State withholding field by the amount removed from Local Withholding.

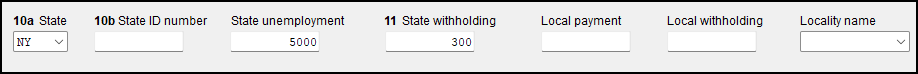

Below is the corrected scenario information:

Important NY EF Message 0199 disallows e-filing of the state return because the State of New York rejects returns submitted with amounts entered in the Local withholding field using rejection codes R-0130 and R-0132.