Drake Tax - KS - EF Message 0127

Article #: 14244

Last Updated: December 05, 2024

Kansas no longer includes the Schedule C, E or F income in the AGI calculation. Since KS does not include these amounts, it is necessary to make an adjustment on the Kansas OSC screen if there are Schedule C, E or F amounts present for other states for which you are claiming this credit.

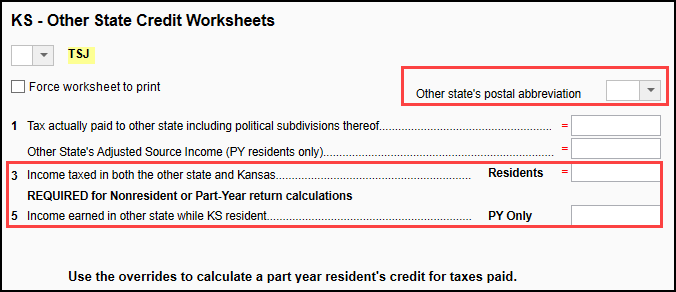

To clear this EF Message, go to the Kansas > Credits tab > OSC (Other State Tax Credit) screen. On this screen, enter the other states postal abbreviation and enter the other states AGI without including the Schedule C, E or F income. This would be done on line 3 for KS residents or line 5 if the taxpayer is a Part-Year or Nonresident of Kansas. Once these entries have been made, the EF Message should clear.