Drake Tax - 8994 - Employer Credit for Paid Family and Medical Leave

Article #: 15867

Last Updated: December 05, 2024

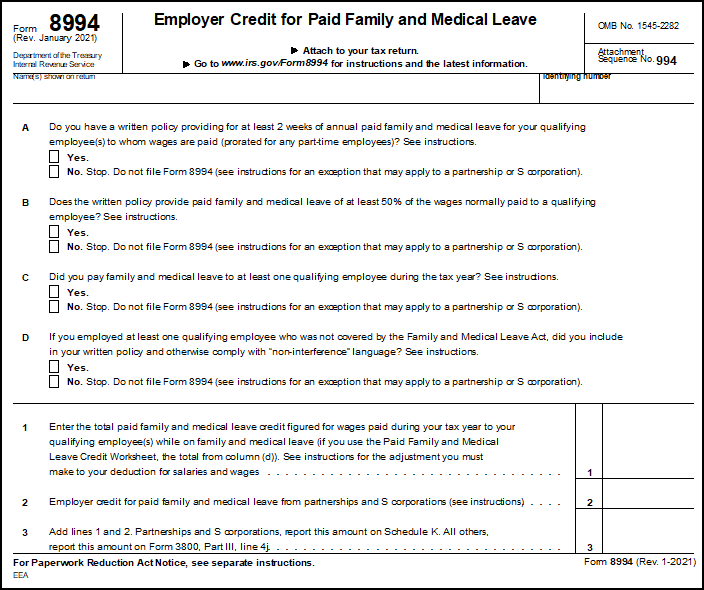

For tax years starting after December 31, 2017, the Tax Cuts and Jobs Act (see page 82) introduced a credit for eligible employers who paid family and medical leave for tax years beginning after 2017. According to the instructions for form 8994, the credit ranges from 12.5% to 25% of wages paid to a qualifying employee while the employee is on family and medical leave.