Drake Tax - KY - EF Messages 1102 and 1103

Article #: 15917

Last Updated: December 05, 2024

Kentucky EF Messages 1102 and 1103 most commonly occur when the federal return is filed as Married Filing Jointly (MFJ) and Kentucky uses a different filing status based on which filing status would be most beneficial for the taxpayer.

There are 3 ways to handle this EF Message when the KY filing status is the cause:

-

Paper-file the return.

-

Go to the States tab > KY > Screen 1 - Individual Income Tax Return > Override the filing status from the drop list.

-

Split the return using (Ctrl+S) and file the states separately. See Drake Tax - Creating, Preparing, e-Filing, and Deleting Split Returns for more information on this process.

EF Message 1102 can also be caused when the override fields on KY screen 1 are used to override the AGI from the federal return on a KY resident return.

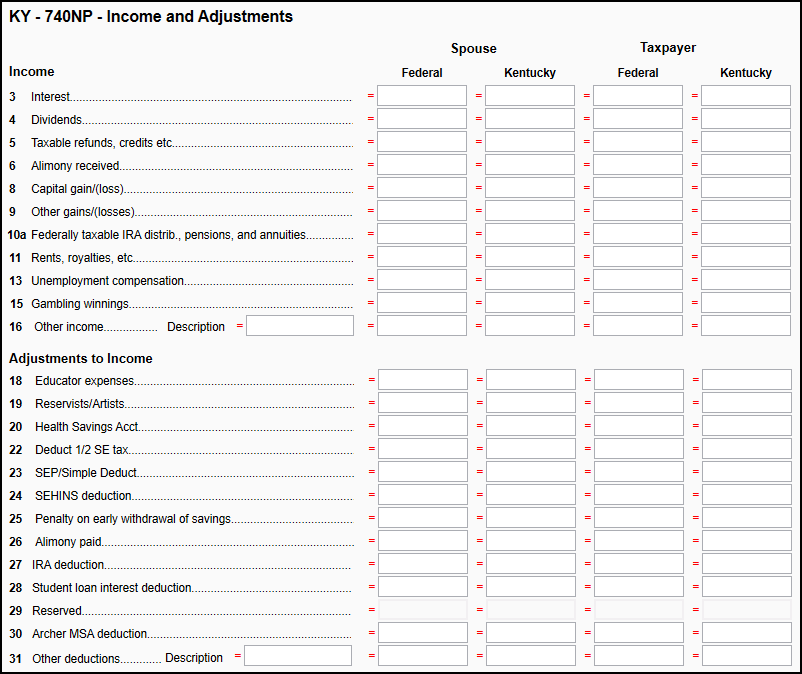

EF Message 1103 can also be caused in a similar way. Using any of the override points on KY screen NP for the taxpayer and/or spouse on a part-year or nonresident return will cause the message to appear.

If an override on these lines is necessary for the return to be correct, the return will have to be paper-filed.