Drake Tax - CA - EF Message 0069

Article #: 15943

Last Updated: December 05, 2024

-

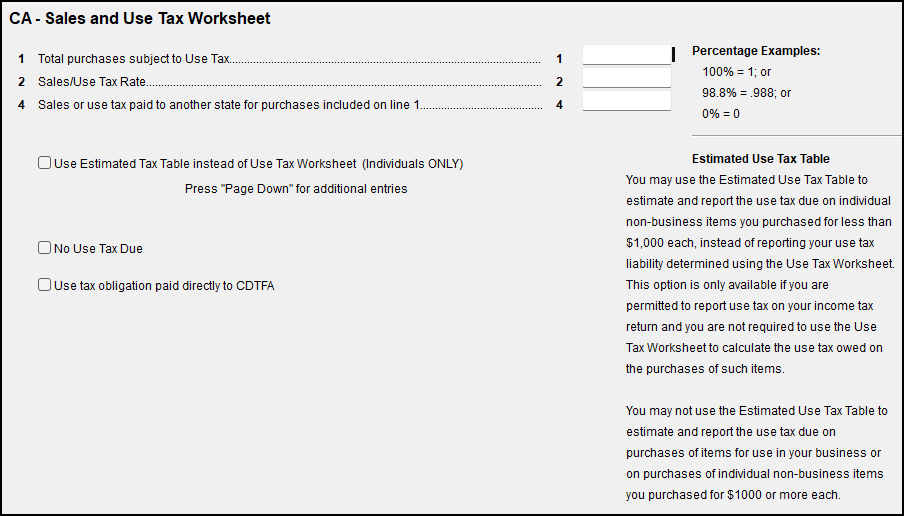

If no Use Tax is due on the return, mark the box to indicate that No Use Tax Due or Use tax obligation paid directly to CDTFA.

-

If Use Tax needs to be computed on the return, complete lines 1-4 as needed to compute use tax due using the Use Tax Worksheet (appears in View/Print mode as CAWK_USE).

-

Certain individual taxpayers can compute use tax due using the Estimated Tax table instead of the Use Tax worksheet. To use the table instead of the worksheet, mark the box Use Estimated Tax Table instead of Use Tax Worksheet (Individuals ONLY) and complete lines 1-4 as needed. No worksheet appears in view when the Use Tax is calculated using this method.

Note Use Tax is reported on CA 540 line 91 or on CA 5402EZ line 26.

Refer to the CA 540 Instruction Booklet for more information.