Drake Tax - NE - EF Message 0061 Payments

Article #: 17799

Last Updated: December 05, 2024

The resolution varies depending on the year of Drake Tax being used.

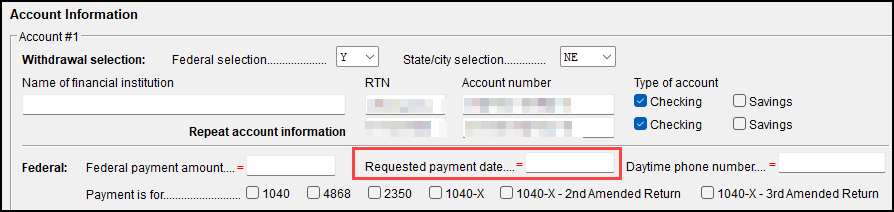

If this is a return for the current filing year, you must review the date entered on the PMT screen and ensure that it is accurate. The date cannot be before today's date or after 12/31/2026 (the last day of the processing year. For example, in Drake Tax 2025, the date must be between the current date and 12/31/2026.

Prior-Year

Nebraska does not allow electronic payments to be made through software vendors for a prior-year filing. To pay the balance due you can either:

-

Pay online through the NE DOR website

-

Mail a check with Form NE 1040V.