Drake Tax - Whatfix Desktop Player

Article #: 18920

Last Updated: February 10, 2026

Drake Software has partnered with Whatfix to provide additional software help within Drake Tax Desktop. If you choose to install the Whatfix Desktop Player, you will be able to search the Drake Software Knowledge, follow guided walkthroughs, and access the Customer Support chat, all without leaving the application.

The Whatfix Desktop Player is designed with security best practices for use with desktop applications. Whatfix does not store or retain sensitive application content, such as tax return data. Data entered in Drake Tax remains within Drake Tax systems.

If you want to use these features, the Whatfix Desktop Player must be installed on each computer running Drake Tax 2025. There is no additional cost for Drake customers to install or use Whatfix. Installation of Whatfix is optional – you can still access the Drake Software Knowledge Base and Customer Support chat from your program or online.

-

Click on the following link to the Whatfix Player Installer.

-

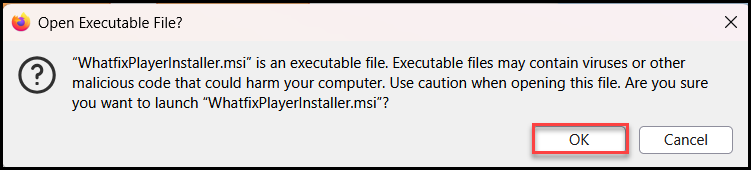

The file download will start. Click OK on the open prompt.

-

If the file does not begin to run after downloading, locate the file WhatfixPlayerInstaller in your Windows Downloadsfolder and double-click to run.

-

-

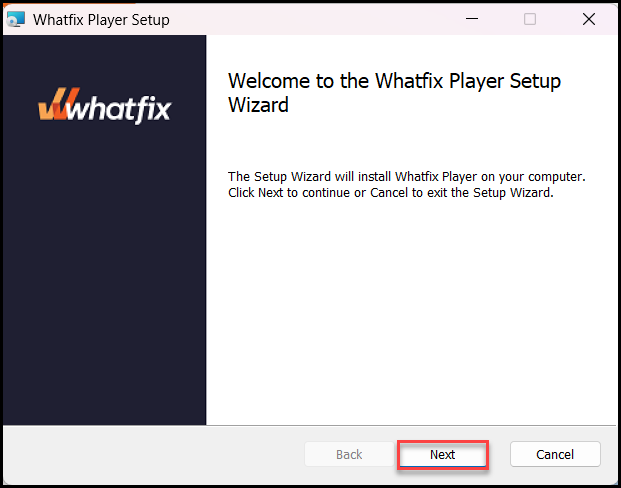

The Whatfix Player Setup wizard window displays. Click Next.

-

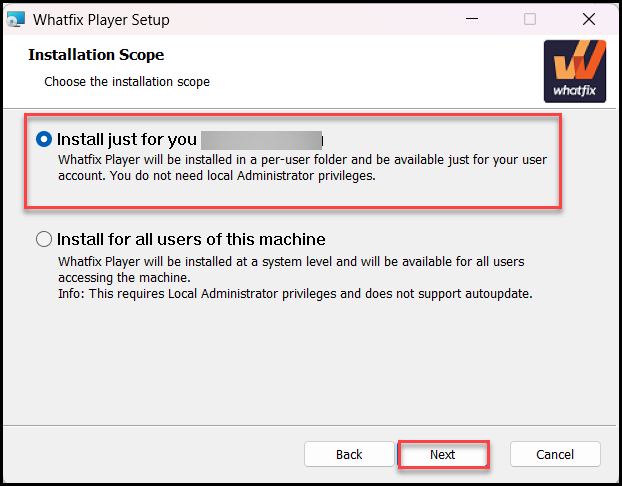

Leave the radio button on the option Install just for you, then click Next.

-

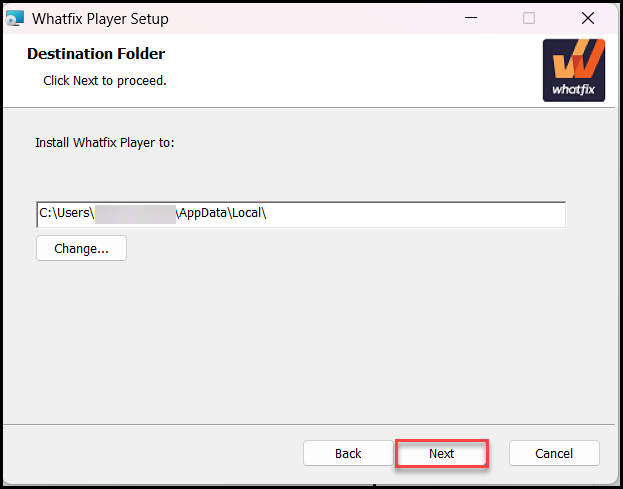

Verify the installation location, then click Next.

-

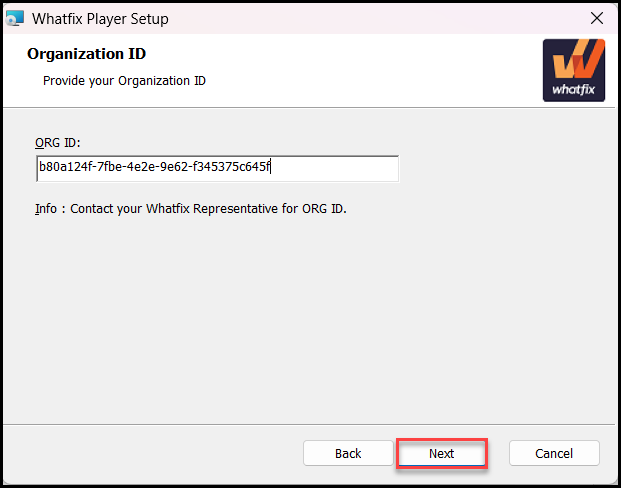

Enter our Organization ID: b80a124f-7fbe-4e2e-9e62-f345375c645f and click Next.

-

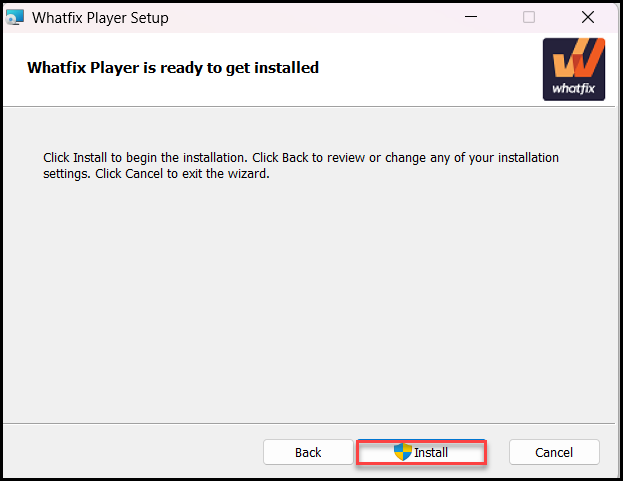

Click Install.

-

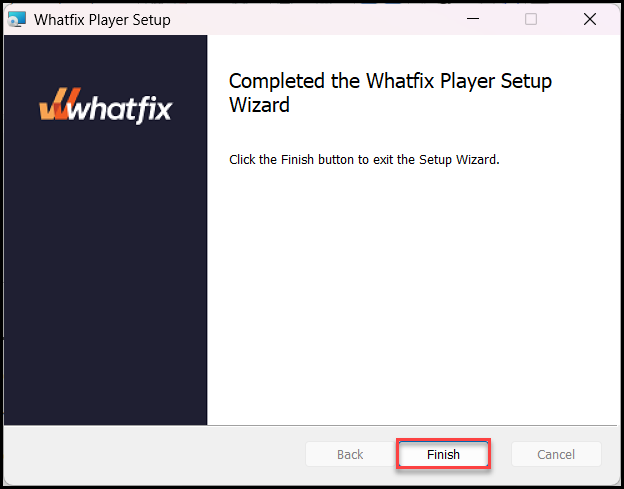

When the wizard is done, click Finish.

-

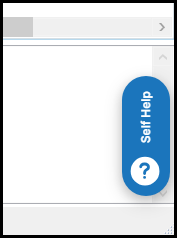

When you return to Drake Tax, you will see the help widget on the lower right of your window.

Note If you do not see the widget, you may need to close and reopen Drake Tax to allow it to launch.

-

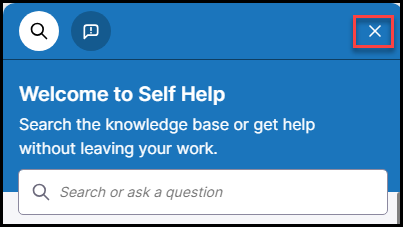

Click on the widget to open the search.

Tip You can reposition the widget to any edge of the program window. When you open another screen it will automatically appear on that screen in the same location.

-

Click the X to close the expanded window..

Frequently Asked Questions

Whatfix is an optional, in-application help tool that provides guided walkthroughs, contextual tips, and quick access to the Drake Software Knowledge Base and Customer Support resources while you work in Drake Tax Desktop.

No. Installation and use of Whatfix is completely optional. Drake Tax Desktop can be used normally, with or without Whatfix installed.

Whatfix does not store or retain sensitive application content, such as tax return data. Data entered in Drake Tax remains within Drake Tax systems.

No. Whatfix is designed to run alongside Drake Tax Desktop with minimal impact on performance.

To use Whatfix in Drake Tax Desktop, the Whatfix Desktop Player must be installed on each computer where you want to use these features. Once installed, you can access help directly within the application. Installation steps are provided above.

Yes. If you choose not to install Whatfix initially, you can install it later from the Drake Tax toolbar by selecting Partners > Whatfix. You can also choose not to use it or uninstall it at any time.

You can uninstall the Whatfix Desktop Player by going to the Control Panel > Programs > Programs and Features > Uninstall a program > select the Whatfix Desktop Player from the list > click Uninstall > Yes.

No. There is no additional cost for Drake customers to install or use Whatfix.

No, Whatfix is not currently available for Drake Accounting.

No, this is currently only available for Drake Tax 2025.