Drake Tax - Single-User and Multi-User Versions

Article #: 18494

Last Updated: November 03, 2025

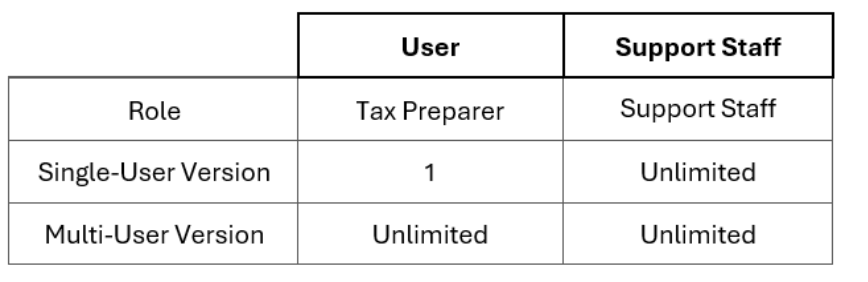

Starting with Drake Tax 2024, you can choose to purchase either the Single-User or Multi-User version of Drake Tax Pro or Drake Tax 1040. The version you choose depends on the number of Users in your firm.

Watch the video Single User vs. Multi-User for more information.

For Drake Tax purposes, a User is a Tax Preparer who, per IRS guidelines, must have a PTIN. Per the IRS, anyone who prepares or assists in preparing federal tax returns for compensation must have a valid PTIN before preparing returns. Users (Tax Preparers) are considered any of the following:

-

A signing tax preparer

-

A nonsigning tax preparer

-

A supervised registered tax preparer

Staff Members

Support Staff are not tax return preparers; anyone who is not required to have a PTIN is not counted as a User. This includes staff members who perform tasks such as data entry, scheduling, reporting, client services, intake, and managing client information. Examples of Support Staff include:

-

A data entry clerk, who enters data into the software while being employed

-

An office assistant who performs tasks in the software related to workflow, customer intake and scheduling, reporting, and customer service

Version Selection

Each tax return preparer in your firm with a PTIN is counted as a User. The Single-User version is for businesses with one tax return preparer (PTIN holder) only and is limited to one User. Firms with multiple tax return preparers (Users) should purchase the Multi-User version.

-

If you have one tax preparer in your firm, choose the Single-User version of Drake Tax, which allows for one User.

-

If you have two or more tax preparers in your firm, choose the Multi-User version, which allows for an unlimited number of Users.

-

If you have more than one firm, choose the Multi-User version. The Multi-User version allows multiple firms, while the Single-User version only allows one firm to be set up; this firm must be used for all returns.

Both versions allow for an unlimited number of Support Staff.

Examples

The following examples illustrate single-user and multi-user scenarios.

Example A

Jane owns Jane’s Tax Service and prepares returns for individuals and businesses. Jane has a PTIN and signs the returns. Jane’s husband, Tom, works in the office and helps Jane with day-to-day operations. Tom schedules appointments, updates client information in Drake Tax as needed, assists clients with preparing for appointments, and maintains software and computer updates.

Jane is a tax preparer, and therefore a User in Drake Tax. Tom performs many office tasks but does not prepare or assist in preparing tax returns and does not have a PTIN. Tom is not a tax return preparer.

Since Jane’s Tax Service has one tax preparer, Jane should purchase the Single-User version of Drake Tax.

Example B

Bill and Sue Finley own and operate Finley’s Tax Service. Sue prepares tax returns for their clients. Bill primarily performs bookkeeping services for their business clients, but he substantially aids Sue in preparing tax returns. They both have PTINs, but Sue typically signs all tax returns.

Their daughter, Annie, works in the office in an administrative role—serving as a receptionist, answering phone calls, scheduling, and occasionally entering or updating client information in Drake Tax. Annie does not prepare or assist in preparing tax returns and therefore does not have a PTIN.

While Bill’s main focus is not tax preparation, he does provide a substantial amount of assistance in preparing tax returns and is therefore required by the IRS to have PTIN. Sue and Bill are both tax preparers and would be considered Users in Drake Tax; Annie is not a tax preparer.

Since there is more than one User at Finley’s Tax Service, the firm would need to purchase the Multi-User version of Drake Tax.

FAQs

No, the Single-User version allows you to set up one User only—meaning one tax return preparer and their PTIN. If your firm has more than one tax preparer, choose the Multi-User version, which allows for unlimited tax preparers (PTIN holders).

-

Data entry clerk: A tax preparer, as defined by the Internal Revenue Code, is any individual who prepares a tax return for compensation, including a CPA or an enrolled agent. A person who enters tax information while being employed, such as a data entry clerk, is not considered a tax preparer and does not need a PTIN, as they are not recommending or advising on tax positions, interpreting the Code, or reviewing returns for accuracy—they are simply entering information.

-

Supervised Registered Tax Preparer (SRTP): An individual who does not, and is not required to, sign a tax return as paid preparer; works at a firm at least 80% owned by CPAs, attorneys, or enrolled agents, and is supervised by a CPA, attorney, or enrolled agent; and has a PTIN. They are a tax preparer.

-

Nonsigning Preparers: Any tax return preparer who is not a signing tax return preparer but who prepares all or a substantial portion of a return or claim for refund with respect to events that have occurred at the time the advice is provided. This includes a person who provides advice (written or oral) about events that have occurred that leads to a position on a return (or claim for refund), and that position constitutes a substantial portion of the return. They are a tax preparer.

Yes. An ERO is considered a User—whether or not they choose to prepare returns— based on their essential duties related to filing tax returns, such as signing Form 8879 and submitting tax returns electronically.

The Single-User version supports one firm only. If you had more than one firm set up in the prior year, only Firm #1 is brought forward when you update your settings to the current year of Drake Tax. If you are planning to use a different firm this year, you can change the details of Firm #1, but you cannot add another firm in Setup > Firms. If you need to file returns with two different firms, you must purchase the Multi-User version instead.

If you need to upgrade, you can now do so online - see Upgrade Tax Software for details.

The fee to upgrade varies depending on which version of Drake Tax you had purchased and which version of Drake Tax you want to upgrade to.

Yes, data entry screens may have minor limitations, including the following:

-

On screen 1, only the single firm and single preparer are available in the Firm and Preparer drop lists.

-

PREP screen entries are limited, as additional/alternate firms and preparers are not available.

Drake Tax PPR uses the Multi-User version by default; you can have as many users as needed.