Drake Accounting - Correcting e-Filed Forms 1099 and W-2/W-3

Article #: 15815

Last Updated: July 22, 2025

Note We recommend that you print or save a copy of any original documents before making changes. Before printing or saving corrected Forms 1099 and associated 1096, uncheck any vendors that do not need corrections, or re-process only the corrected forms.

Only follow these steps if the e-file was accepted by the FIRE site. If the file was rejected or had a "BAD" status, do not use the Corrected checkbox. When an e-file is rejected, the e-file can be submitted again.

Payables

-

Go to Payables > Federal Forms > Select the desired Form 1099 from the Form drop list.

-

Select the Vendor that needs to be corrected.

-

The 1099 must be processed to allow changes.

-

-

Select the Corrected box, above the Form 1099 and make necessary changes.

-

Click Save or Save/Print to finalize the changes.

On the Fly

-

Go to On the Fly > Federal Forms > Forms 1099 (default) > select the desired Form 1099 from the Form Type drop list.

-

Select the Vendor that needs to be corrected.

-

On the Fly forms do not have a process option.

-

-

Select the Corrected box, above the Form 1099 and make necessary changes.

-

Click Save or Save/Print to finalize the changes.

Employees

The steps for creating the W-2c/W-3c are the same for Employees and On the Fly forms.

-

Go to Employees > Federal Forms.

-

or On the Fly > Federal Forms

-

-

Select Forms W-2c/W-3c from the Form Type drop list and W-2c from the Form drop list..

-

Select the employees from the list on the left side of the window that require corrections.

-

Click Process.

-

Select an employee’s W-2c by either double-clicking the employee or using the Find Employee drop list at the top of the window. You can also page through the processed forms using the page tabs.

-

Make necessary changes directly in the appropriate fields.

-

Repeat steps 5-6 until all edits have been made and then click Save or Save/Print to save your changes.

You can print forms W-2c or W-3c at this time, or click Save to print them at a later time. To print at a later time, go to Tools > Review Reports and select Display Federal Reports (PDF) from the drop list.

The edited forms W-2c are saved and an updated W-3c is generated. If the Print W-3c check box is selected when you click Save/Print, the W-3c displays in a separate PDF window.

Note All forms W-2c and W-3c can be printed on plain paper using a laser printer and on red line forms using the data only option.

Filing

Corrected 1099

See General Instructions for Certain Information Returns for filing requirements.

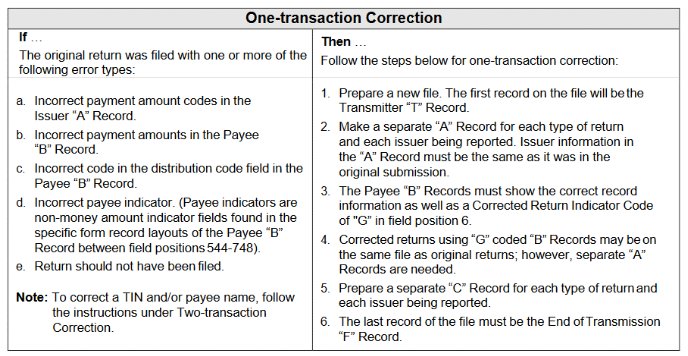

Important A corrected Form 1099 can only be e-filed through DAS if the correction that was made to the form is considered a one-transaction correction. See Publication 1220 for more information about one and two-transaction corrections.

When e-filing a corrected 1099, follow the chart below from Publication 1220:

Form W-2c or W-3c

Note Drake Accounting requires a processed W-2/W-3 in order to create a W-2c/W-3c. Forms W-2c/W-3c cannot be e-filed through Drake Accounting at this time. These forms must be paper-filed.

Form W-2c is used to correct Form W2. Form W-2c is not intended to report back pay or to correct Form W-2G, Certain Gambling Winnings.

Form W-3c is required to be filed with Form W-2c and is automatically produced in the background when Forms W-2c are processed.