Drake Accounting - TIN Masking Options for Forms W2/1099/1098

Article #: 15763

Last Updated: December 05, 2024

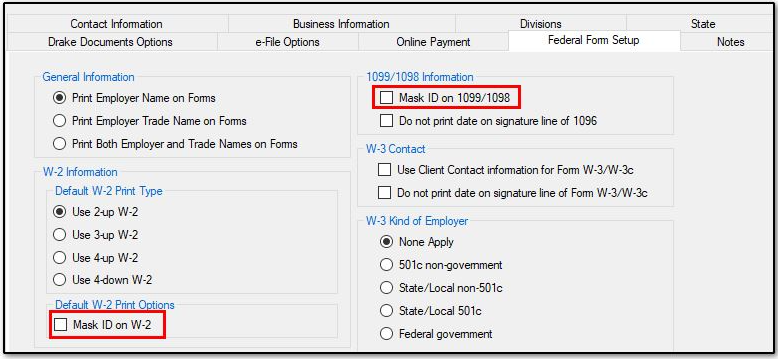

The option Mask ID on 1099/1098 is available from the Client > Add or Edit window, on the Federal Form Setup tab.

The option Mask ID on W-2 is available from the Client > Add or Edit window, on the Federal Form Setup tab.

A masked ID number prints with an X in the first five positions, with only the last four visible (i.e. XXX-XX-1234).

Notes:

-

The IRS requires the full ID number to be displayed on Copy A or Copy 1, therefore, masking will not be applied to either copy.

-

Masking does not apply to the filer's TIN.

-

Per the instructions: "A filer's TIN may not be truncated on any form."

-

-

Masking is not allowed on Form W-2G.

-

Per the instructions: "Filers of information returns are permitted to truncate a payee's TIN (SSN, ITIN, ATIN, or EIN) on most payee statements. The payee's TIN may not be truncated on Form W2-G."

-