Drake Accounting - Extension of Time to File Information Returns

Article #: 15855

Last Updated: December 05, 2024

To request an extension, complete and file Form 8809, Application for Extension of Time To File Information Returns. Form 8809 is available under Tools > Print Blank Forms > Federal > Miscellaneous > 8809 or under On The Fly> Federal Forms > Miscellaneous > 8809.

Caution Extension requests for Forms 1099-NEC, 1099-QA, 5498-QA, and W-2 must be submitted on paper

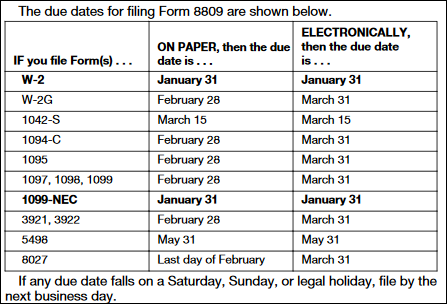

The due dates for non-extended informational returns are:

Extensions on Form 8809 may be requested:

-

Online (preferred):

-

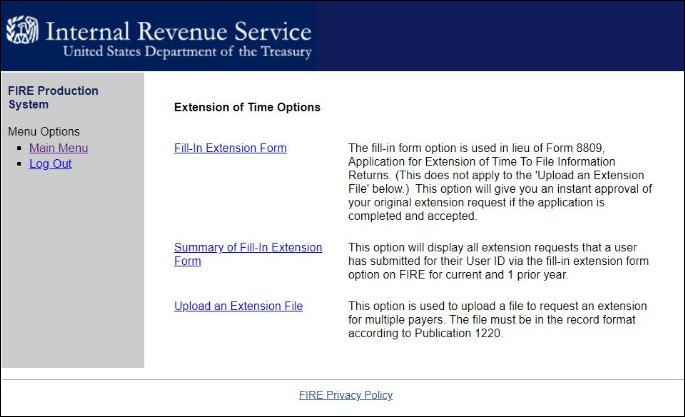

Complete the fill-in Form 8809 through the IRS FIRE system.

-

After logging in, select “Extension of Time Request” from the Main Menu Options.

-

Acknowledgements are automatically displayed online if the request is made by the due date of the return.

-

-

On paper - Form 8809:

-

Mail the form to:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0209

-

See the Form 8809 Instructions for more information, other filing options, or to access a fillable PDF of the form.

Alternatively, for a 1099 series return extension only, complete the following steps:

-

Go to e-Filings > 1099/1098 > Create Extension File.

-

Enter the TCC.

Note A Transmitter Control Code must be obtained to e-file 1099/1098 information. This is a five-character alphanumeric code assigned by the IRS/ECC-MTB.

-

Complete the Payer Information section:

-

TIN — Enter the nine-digit Taxpayer Identification Number assigned to the taxpayer. A number that is all zeros, ones, twos, etc., results in an invalid TIN.

-

Name — Enter the name of the payer whose TIN has been entered. If additional room is needed for the name, use the Second Name field.

-

Foreign Entity Indicator — Select this box if the payer is a foreign entity.

-

Address — Enter the address of the payer. The street address should include number, street, apartment or suite number, or PO Box if mail is not delivered to a street address.

-

City — Enter the city, town, or post office of the payer.

-

State — Enter the two-character state code.

-

Zip — Enter the nine-digit ZIP code assigned by the U.S. Postal Service. If only the first five digits are known, then use the five-digit ZIP code.

-

-

Click Create File.

To transmit Forms 1099 and 1099 extension requests:

-

Go to e-Filings > 1099/1098 > Transmit File.

-

Click the FIRE Production Link to access the IRS FIRE website and upload Forms 1099 and 1099 extension requests.

-

Click the FIRE Test Link to access the IRS FIRE test website. Use this to send a test file for a state that you have not previously uploaded to the IRS.

-

Once connected to the FIRE website, click Log On.

-

Enter your TCC, EIN, Company Name, User ID and Password (the password is case sensitive) and click Login.

-

Click Continue.

-

Click Send Information Returns.

-

Click Submit.

-

Click Accept.

-

Click either Original File or Replacement File (if the original return had a BAD status).

-

Enter your 10-digit PIN and click Submit.

-

Click Browse to locate the file and open it.

-

Click Upload.