Drake Tax - Mask SSN, EFIN, PTIN on Client and Preparer Sets

Article #: 14034

Last Updated: November 03, 2025

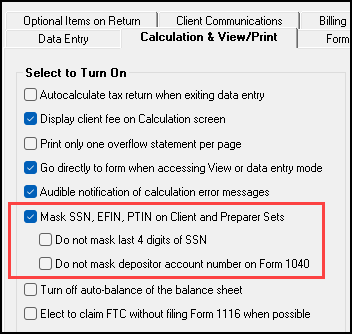

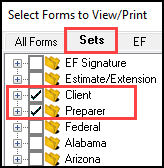

You can enable the option Mask SSN, EFIN, PTIN on Client and Preparer Sets in Setup > Options > Calculation & View/Print tab. This will mask the SSN, EFIN and PTIN when you select to print forms from the Client and Preparer sets.

-

This option is applied when a set is printed using the Drake PDF Printer, or to a physical printer.

-

When you print the Client or Preparer set from Enhanced View/Print mode, the numbers will be replaced with Xs.

-

Masking is available for the SSN, EFIN, and PTIN in all return types.

-

EINs are not masked with any setup option for any return type.

Note At least 2 forms from the client or preparer set must be selected to be printed for the masking to be applied.

Two additional options are available when you select Mask SSN, EFIN, PTIN on Client and Preparer Sets. The additional options are:

-

Do not mask last 4 digits of SSN

-

Do not mask depositor account number on Form 1040

Important Masking of account numbers may not be available for all state returns. See below for details.

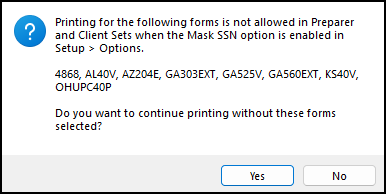

Printing Not Allowed

Certain forms, such as federal or state vouchers, extension forms, and other scanning enabled forms, are unable to be printed with the masking enabled. If these forms were to be sent to the IRS or a state tax agency without the taxpayer’s SSN, the payment or form would not be processed. To ensure that the correct version of the voucher is used, you must print vouchers and other scannable forms from the Federal and State sets or from All Forms instead. A message page will show when this applies to selected form(s):

These pages will have to be printed from the Federal or State set, or from All Forms so that there will not be processing issues when received by the taxing agency.

Ohio

Ohio is now producing a watermark when printing from sets with this option enabled; see Drake Tax - Watermarks Available in View/Print for Documents and Sets for details.

Masking Unexpected

If you do not have the above setup option enabled, but are still seeing Xs instead of numbers printed, make sure that you do not have any EF Messages indicating that there is an issue with your data entry. Xs are printed as a placeholder when there is no valid account information to print.

-

When filing Form 1040-X, the taxpayer can get their refund direct deposited, but ONLY if the return is being e-filed. When Form 1040-X is paper-filed, the additional refund is sent via paper-check, so direct deposit information is not included. Even if e-filing, the printed Form 1040 will show Xs, but a note is displayed at the bottom of Form 1040-X, page 1 that says Refund will be issued via direct deposit. Refer to the transaction summary for details.

If the Xs are showing in View/Print mode, but not when you print, see Drake Tax - View/Print Mode Setup Options instead.

If you want to change how bank account numbers are displayed on Form 8879, go to Setup > Options > Form & Schedule Options and from the Form 8879 bank account options drop list select the option you need. See Form 8879 - Frequently Asked Questions for other information about Form 8879.