Drake Tax - 1040 - State Extensions Screen (STEX)

Article #: 16440

Last Updated: December 05, 2024

The STEX screen is used to generate all state extensions from the same location. Watch the video STEX Screen for a demonstration.

-

Open the STEX screen.

-

On the first tab choose either:

-

Generate all eligible state extensions using the current-year data provided - This check box will generate all eligible state extensions, as long as there is a state return being calculated. The software will generate an extension form typically with the current year calculated amount due. If the state results in a $0 due calculation and allows a $0 due extension this will also be generated.

-

Generate all eligible state extensions with a $0 payment, if necessary - Mark this box to generate $0 extension for the states or cities that allow or require an extension to be filed even when no payment is due. The state return for which an extension is needed, must be generated on the return for this check box to apply.

-

Reason for Extension

If the state requires a reason for requesting an extension, type that reason into the Reason for Extension text box. Only Connecticut, Georgia, Kentucky, New Mexico, and Pennsylvania require such a statement. Otherwise, your entry will not be carried to the state extension request.

States or Cities Requiring More Information

Some states and cities require you to provide more information before an extension can be generated. These are listed on the right with hyperlinks to the appropriate data entry.

States or Cities allowing multiple or additional EXT products

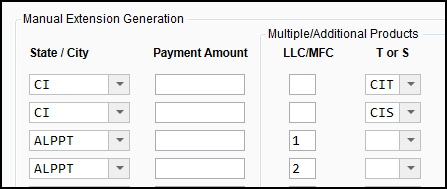

There are a few states and cities that allow for multiple extensions to be generated for a particular return. These states and cities require additional data entry on the STEX screen before a state/city extension may be generated. Examples include the AL PPT or various state SMLLCs where some basic data entry is required and the extension form generated since there may be several of each type of return for a single taxpayer. In these instances, the Multiple/Additional Products section of the STEX screen must be used.

Manual Extension Generation

This section can be used in addition to, or in lieu of Generate all eligible state extensions using the current-year data provided. The manual section can also be used in addition to or in lieu of the Generate all eligible state extensions with a $0 payment, if necessary option. The Manual Extension Generation section behaves as an override for the particular state entered, if or when either of the Generate all options has been marked. Select the State/City in the drop list and enter a payment amount (if applicable).

If you need assistance in calculating the payment amount, you can use the link for Extension Payment Worksheet. Complete the applicable lines, close the worksheet, and the payment amount resulting from this entry will be automatically populated in the field for the state entered. Any amount entered in the Payment Amount field after the worksheet has been completed will behave as an override for the worksheet calculation.

Amount Paid with Extensions

When you are ready to file the regular return, you have two options. Both options are available on the STEX screen by clicking the tab Amount Paid with Extension at the top or by going to the STX2 screen. Here you can check either:

-

All Extensions listed were previously filed; ready to file all state and city tax returns,

-

Extension was previously filed; ready to file state/city tax return next to the states that you are ready to file.

Note By selecting Extension was previously filed; ready to file state/city tax return, you are verifying that the calculated payment amount (gray) is correct. If the taxpayer paid a different amount than what was calculated, enter the amount actually paid in the override field. If the Amount Paid box is empty, the software will default to the Calculated Amount as having been paid.