Drake Accounting - State Wage Forms Zeroed Out

Article #: 15081

Last Updated: December 05, 2024

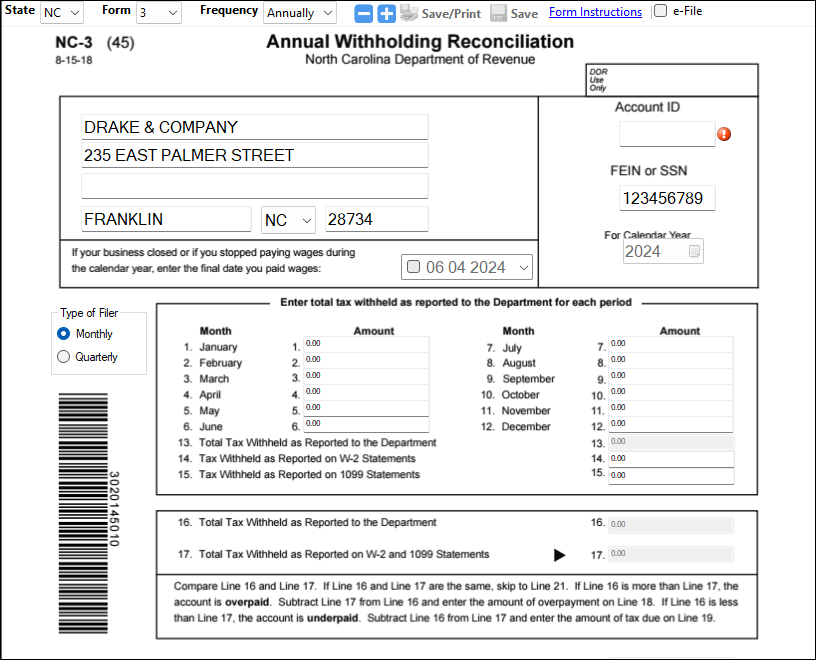

The information produced on the State Tax & Wage Forms come from what has been entered within payroll and within the State Rates and Withholding Setup.

If you have not entered anything for the state under Firm > Rates & Withholding Setup > State Setup or haven’t entered the right state for employee’s payroll, it will cause the state form to be zeroed out.

To make sure that state has been selected for the client and the employees:

-

Go to Firm > Rates & Withholding Setup > State Setup. On this window, select the state in which the active client is located, as well as the client to which the state rates will apply. Enter all of the correct rates and withholdings which apply for that particular state. Click Save.

-

Go to Employees> Employee Setup. When creating the employee, make sure the employee’s address is located in the correct state and make sure that the state is selected in the tax table under the State Tax tab. This will ensure that once payroll has been calculated, the information will flow to the state wage form properly.