Drake Accounting - PA UC-2 and UC-2A Calculation

Article #: 15843

Last Updated: December 05, 2024

PAUI needs to be setup to ensure the correct calculation of forms UC-2 and UC-2A. In setting up PAUI, you will make entries at:

-

Firm > Rates & Withholding Setup > State Setup

-

Employees > Deduction & Benefits > Deductions tab

-

Employees > Employee Setup > Deductions tab

Note The PA UC-2 and UC-2A cannot be saved unless the PA Unemployment ID has been entered in correct format (for example, 12-3456) at Client > Edit > Contact Information tab.

-

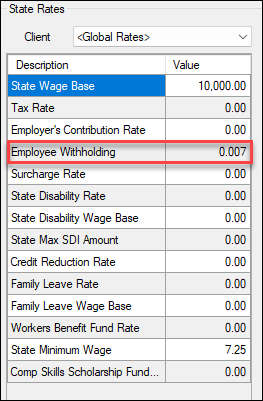

Go to Firm > Rates & Withholding Setup > State Setup > Select PA on the left.

-

Enter the employee contribution rate in the Employee Withholding field.

Important Amount used above is only for demonstration.

-

Click Save.

-

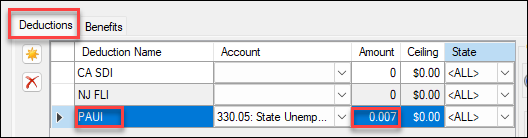

Go to Employees > Deduction & Benefits.

-

Set up a PAUI deduction.

Important Do not use a withholding Code.

-

Click Save.

-

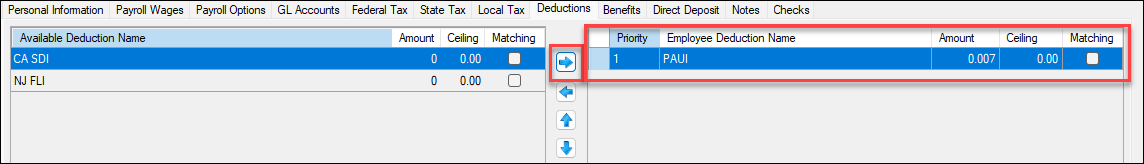

Go to Employees > Employee setup.

-

Select the applicable employee.

-

Go to the Deductions tab and click on PAUI under Available Deduction Name (on the left).

-

Click the right arrow (

) to transfer to the Employee Deduction Name (on the right).

) to transfer to the Employee Deduction Name (on the right). -

Click Save.

These entries will include the PAUI deduction when you prepare and print payroll.

The PAUI information also will be carried to PA Form UC-2, line 3 (Employee Withholding Rate (.0007 used in this example) x Gross Wages (865.38 in Box 2) = Employee Contributions).