Drake Accounting - W-2 Withholding Codes

Article #: 15912

Last Updated: November 03, 2025

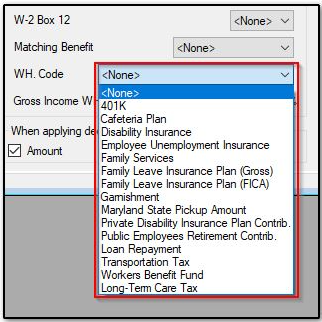

When setting up deductions at Employees > Deductions & Benefits, you can choose from the following list of withholding codes:

W-2 Withholding Codes

-

<None>

-

401K

-

Cafeteria Plan

-

Disability Insurance

-

Employee Unemployment Insurance

-

Family Services

-

Family Leave Insurance Plan (Gross)

-

Family Leave Insurance Plan (FICA)

-

Garnishment

-

Maryland State Pickup Amount - This is a mandatory employee retirement deduction for all employees in Maryland that participate in the retirement system. This deduction is not subject to federal tax but is subject to Maryland state and local tax. If this withholding applies, also select the W-2 Box 14.

-

Private Disability Insurance Plan Contrib.

-

Employee’s contribution to a private disability insurance plan - When a deduction is set up using this withholding code, you must also select the Employer has Private Disability Plan check box and enter the Plan Number (Client > Edit > Business Information).

-

Public Employees Retirement Contrib.

-

Employee's contribution to a public employee's retirement system.

-

Loan Repayment

-

Transportation Tax

-

Workers' Benefit Fund

-

Long-Term Care Tax