Drake Accounting - LA - Wage Report Must be e-Filed

Article #: 16312

Last Updated: December 05, 2024

For filing to the Louisiana Workforce Commission (LWC), DAS produces:

-

A PDF copy of LA Form 4BC, Employer's Quarterly Wage and Tax Report for record-keeping purposes only.

-

A .txt file for e-filing to the LWC website.

Note Louisiana requires all Wage Reports to be filed electronically.

Producing the Louisiana Wage Report

-

Select the Employees or On the Fly menu, then State Tax & Wage Forms.

-

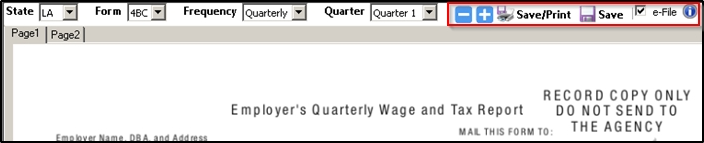

Make sure LA is selected, then select 4BC from the Form drop list and the applicable quarter.

-

Review the form and make any necessary entries or edits.

-

Make sure the e-file checkbox is marked at the top of the screen, then select Save/Print.

Save/Print produces a PDF copy of the form for employer/preparer records only, and the .txt file for upload to the Louisiana Workforce Commission.

e-Filing the Louisiana Wage Report

-

Go to the LWC Employer/Agent Login screen and log in to your account.

-

Select Upload Wage Data File, then select TXT as the file type.

-

Browse to the drive DAS is installed on > DrakeAccounting20YY > DAS20YYData > Clients > client code > EFile > LA > LA4BC (DrakeAccounting20YY > Clients > client code > EFile > LA > LA4BC in DAS20 and prior) and select the file named LA4BC_YYYY-MM-DD_HR_MIN_SEC.txt (where YYYY-MM-DD_HR_MIN_SEC is the date and time of the file creation).

For further information about e-filing the Louisiana Wage Report, see the LWC FAQs.