Drake Accounting - CT - Employer Contribution Return UC-2

Article #: 16313

Last Updated: December 05, 2024

For filing to the Connecticut Department of Labor, DAS produces:

-

A PDF copy of Form UC-2, Employer Contribution Return, for record-keeping purposes only.

-

A .txt file for e-filing to the Connecticut Department of Labor website.

To produce the Connecticut Wage Report:

-

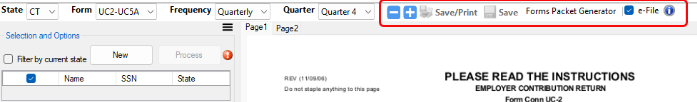

Select the Employees or On the Fly menu, then select State Tax & Wage Forms.

-

Make sure CT is selected and select UC2-UC5A from the Form droplist and the applicable quarter.

-

Review the form and make any necessary entries or edits.

-

Make sure the e-file checkbox is marked at the top of the screen, then select Save/Print.

Save/Print produces a watermarked PDF copy of the form and the .txt file for upload to the Connecticut Department of Labor.

Caution The Connecticut Department of Labor does not provide form specifications for the UC-2 and will not approve a computer-generated form. DAS cannot offer an approved UC-2 form for paper-filing unless this changes.

To e-file:

-

Go to the Connecticut Department of Labor website and log in.

-

Follow the menu options to upload the wage file.

-

The upload file can be found by browsing to the drive where DAS is installed > DrakeAccounting20YY > DAS20YYData > Clients > client code > EFile > CT > CTUC2UC5A (DrakeAccounting20YY > Clients > client code > EFile > CT > CTUC2UC5A in DAS20 and prior)and selecting the file named CTUC2UC5A_YYYY-MM-DD_HR_MIN_SEC.txt (where YYYY-MM-DD_HR_MIN_SEC is the date and time of file creation).

For more information about e-filing the Connecticut wage report, see the UI Tax Division FAQs.