Drake Tax - Forms W-2 and 1099 in View and Sets

Article #: 10623

Last Updated: December 05, 2024

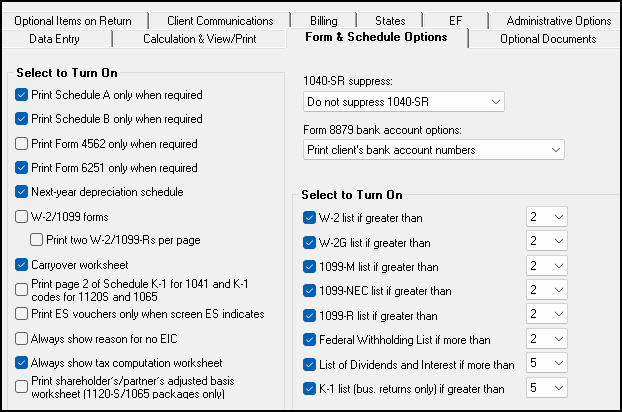

At Setup > Options > Form & Schedule Options, you can select to print select forms in View/Print mode. Other forms are not available for printing, however, you can print a list of the forms that have been entered.

Forms 1099-MISC, 1099-DIV, and 1099-INT are not produced in View/Print mode. Form W-2, Form 1099-R, and Form 1099-G are produced in View/Print mode.

Lists are available for the following forms or items:

-

Form W-2

-

Form W-2G

-

Form 1099-M

-

Form 1099-NEC

-

Form 1099-R

-

Federal Withholding

-

List of Dividends and Interest (Form 1099-DIV or Form 1099-INT)

-

K-1 (1065 and 1120-S returns only)

The lists identify data entry made on each screen. Set the option to 0 (zero) if you want the list displayed in View/Print mode if even a single form has been entered.

State Info

The 1099-R Detail Listing displays state information under State Code, Taxable, and State W/H columns.

Sets

When selected, the lists are included in the Client and Preparer sets by default.

You can change the sets in which these lists appear. The change is global and applies to all returns. You can make the change while you are in a return where they are displayed, or you can do it in Setup.

To add or remove a list in a return where it is displayed,

-

Go to View/Print mode and right-click the list.

-

Select Setup > Form Properties.

-

Modify the number of copies per set and click Save.

To add or remove a list in Setup,

-

Go to Setup > Printing > Printer Setup and click the Sets button at the bottom of the dialog box.

-

Select the return type under Form Categories.

-

Double click the appropriate list form.

-

Modify the number of copies per set and click Update.

-

Click Save to save the changes.

The list form numbers are as follows:

| List Form Name | List Form Number |

|---|---|

| W-2 Listing | 0327 |

| W-2G Listing | 0194 |

| 1099-M Listing | 0195 |

| 1099-NEC Listing | 0192 |

| 1099-R Listing | 0328 |

| Federal Withholding Listing | 0305 |

| Dividend Listing | 0326 |

| Interest Listing | 0336 |

| Form K-1 Listing (1065 and 1120-S returns only) | 0210 |