Drake Tax - 706/1040: Using The Same SSN on Both Returns

Article #: 10807

Last Updated: December 05, 2024

You can create a 706 or a 706A return with the same SSN as an existing 1040 return. Using a 1040 return as an example:

-

Create or update the 1040 return. Note the SSN of the return and close the return, if it is open.

-

Back up the original file before proceeding (optional, but recommended).

-

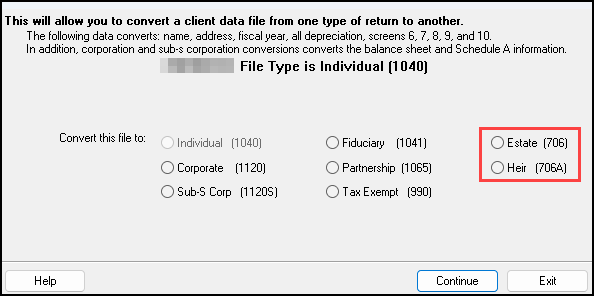

In the software, go to Tools > File Maintenance > Change File Type and enter the SSN and click OK. On the Convert Client Data File Type screen, the selected return is a 1040, so that option is disabled. Note that the list of available return types includes the selections Estate (706) and Heir (706A) on the right side of the screen.

-

Click either option Estate (706) or Heir (706A) to select it and then click Continue.

-

When asked if you want to keep the original return in addition to the new return, click Yes and then click OK.

The SSN is now applied to both the original return and the new return. In the future, when you enter the SSN to open a return, you will be asked which return you wish to open. When you use other features of the program where SSNs are entered (such as in the Client Selection dialog box in Tools > Letters > Letters), you will be prompted to indicate which return the program should use.

This process can be run the other way, starting with a 706 or 706A return to create an individual return with the same SSN.

Caution This feature is not available to users who purchased the Drake Tax PPR or Drake Tax 1040 packages.